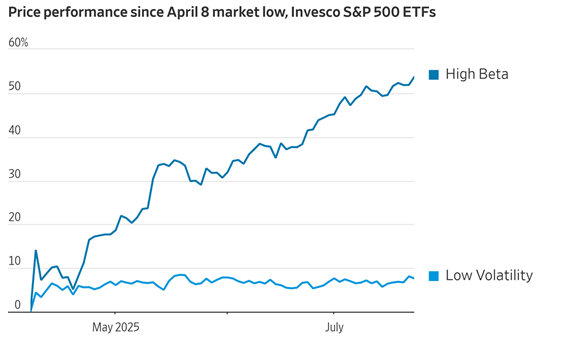

“Pay Me for the Risk” – High Beta Outperforms

Since early April market lows, Invesco’s S&P 500 High Beta ETF has outperformed its Low Volatility ETF by an incredible 46%.

Source: Invesco ETF Performance Data, July 2025

Why it matters:

Markets right now are rewarding investors who lean into more volatile, high-risk companies. That can feel exciting — and profitable — when things are going well. But history shows that this type of outperformance can reverse sharply when market sentiment changes. For retirees and those nearing retirement, the real risk is that a sudden downturn forces you to sell at a loss to meet living expenses. In our approach, we participate in growth opportunities, but always with a focus on balancing risk so your income plan remains steady and your lifestyle is protected — even if market conditions swing in the other direction.

AI May Be Boosting Google Search

Over the past two years, there has been constant talk about AI disrupting — or even killing — Google search. Instead, AI integration may actually be driving more searches.

Source: Alphabet Q2 2025 Earnings Call, CEO Sundar Pichai

Why it matters:

This is a great example of how innovation doesn’t always replace established leaders — sometimes it makes them stronger. For investors, it’s a reminder that well-managed companies can adapt and thrive even in the face of disruption. That adaptability is exactly what we look for when selecting investments for your portfolio. It helps ensure that your assets are positioned to benefit from technological shifts, not be blindsided by them.

Oppenheimer’s Bold S&P 500 Forecast

Oppenheimer Asset Management has issued a research note suggesting that trade progress could push the S&P 500 to a third consecutive year of 20%+ gains.

Source: Oppenheimer Research Note, July 2025

Why it matters:

Predictions like this grab headlines, but they also illustrate why we don’t base retirement plans solely on market forecasts. While such growth is possible, we plan for a wide range of scenarios — both good and bad — so your income needs and long-term goals remain on track regardless of whether Wall Street is overly optimistic or pessimistic. That way, your retirement lifestyle isn’t tied to the accuracy of someone else’s prediction.

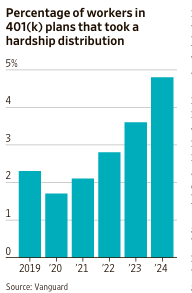

Hardship Withdrawals from 401(k)s Rising

Vanguard reports that 4.8% of Americans took a hardship withdrawal from their 401(k) in 2024, compared with a pre-pandemic average of about 2%.

Source: Vanguard “How America Saves 2025” Report

Why it matters:

Pulling from retirement accounts early can be a double hit — you not only reduce your future nest egg, but you may also face taxes and penalties. This trend signals that many households are still feeling financial pressure despite strong markets. For you, it’s a reminder of why we keep a proper cash reserve in your plan — so you never need to disrupt your long-term investments or jeopardize your retirement income to handle an unexpected expense.

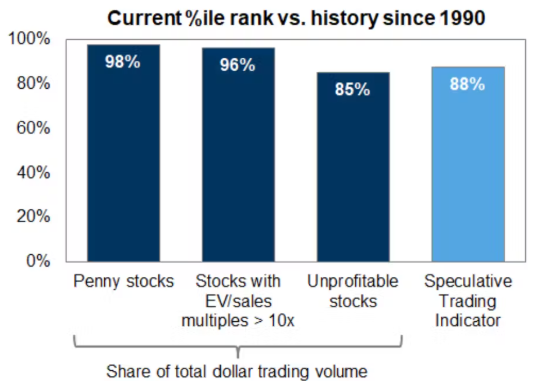

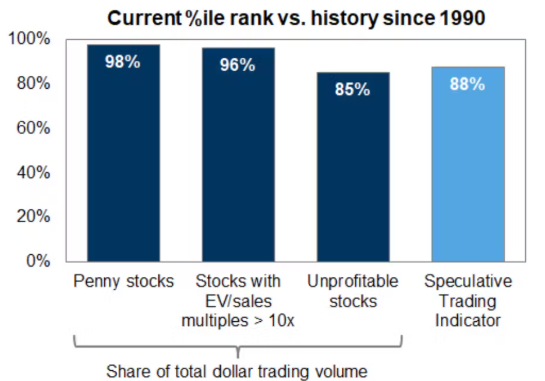

Speculative Trading Spikes

Goldman Sachs’ Speculative Trading Indicator has seen a sharp increase. Historically, in the last 35 years, other jumps like this have often coincided with above-average 12-month S&P 500 returns.

Source: Goldman Sachs Research, July 2025

Why it matters:

It’s true that periods of speculative enthusiasm can lift markets in the short term, but they also raise the risk of sudden corrections. Our role is to navigate these conditions so we capture enough upside to grow your wealth without overexposing you to the kind of downturns that can derail a retirement plan. We aim to make the most of the good times while always preparing for when sentiment shifts.

Existing Home Sales at a 30-Year Low

Existing home sales are about 1.3 million units per year below the pre-COVID average, representing the slowest pace in three decades.

Source: National Association of Realtors, June 2025

Why it matters:

Limited inventory is keeping housing prices elevated, which can be a plus if you own property. But it also means that downsizing, relocating, or buying a vacation home in retirement could be more expensive and competitive. Housing decisions are a major part of retirement planning, and making them early can give you more options and less financial pressure.

Consumer Sentiment Still the Driver

Despite the focus on official economic data, consumer sentiment — how people feel about their financial situation — is often the real driver of spending and economic activity.

Source: University of Michigan Consumer Sentiment Index, July 2025

Why it matters:

Even the best government reports can’t always predict how markets will behave in the short term because markets respond to emotion as much as facts. That’s why we plan based on your personal needs and time horizon, not just on the latest economic print. When sentiment swings, we stay disciplined so temporary volatility doesn’t turn into permanent loss.

Longevity Planning Now Essential

MIT’s AgeLab says today’s 65-year-old has a 50% chance of living to at least age 95.

Source: MIT AgeLab Longevity Study, 2025

Why it matters:

A 30-year retirement is now a realistic possibility, and it requires careful planning to ensure your assets last as long as you do. That means factoring in inflation, rising healthcare costs, and market fluctuations over multiple decades. Longevity planning isn’t just about avoiding running out of money — it’s about maintaining your independence, flexibility, and quality of life for as long as possible..

Rising Medical Costs in Retirement

Fidelity estimates that a 65-year-old couple will need about $172,500 to cover medical expenses in retirement, and that doesn’t include long-term care.

Source: Fidelity Retiree Health Care Cost Estimate, 2025

Why it matters:

Healthcare is one of the most predictable and significant costs you’ll face in retirement — and it tends to rise faster than overall inflation. Building these expenses into your plan now means fewer surprises later. We also explore strategies like Health Savings Accounts, supplemental insurance, and long-term care planning to protect both your health and your wealth.

Estate Planning is a Top Client Priority

According to Financial Advisor Magazine, 93% of clients want estate planning services integrated into their advisor relationship.

Source: Financial Advisor Magazine, July 2025

Why it matters:

Estate planning ensures that your wishes are carried out and your wealth is transferred efficiently and according to your values. It’s not just for the ultra-wealthy — it’s for anyone who wants to minimize family stress, reduce taxes, and create a lasting legacy. We make estate planning a standard part of the wealth management process because it’s inseparable from your overall financial picture.

✅ Final Thoughts:

This week’s headlines highlight a clear theme — opportunity and risk often arrive hand-in-hand. Whether it’s high-beta stocks outpacing the market, AI reshaping familiar companies, or a housing market at historic lows, every trend comes with both upside potential and hidden pitfalls. For retirees and those nearing retirement, the goal isn’t to chase every opportunity, but to participate strategically, protect against the risks that matter most, and keep your income plan strong no matter what the market delivers. By planning ahead — for longevity, healthcare costs, and legacy — you maintain control over the one thing that truly matters: your lifestyle and peace of mind.