According to Apollo, if you believe in historical patterns, the SP500 valuation indicates investors should expect ZERO returns over the next decade.

Apollo’s research suggests that, based on current high valuations, the S&P 500 could deliver flat returns over the next 10 years—a “lost decade” for US stocks.

Source: Business Insider

Commentary:

For retirees and those nearing retirement, this is a loud wake-up call to avoid over-concentration in US large-cap stocks. A truly diversified portfolio, including international stocks, alternatives, and fixed income, is essential. Relying on history-based equity returns for your retirement withdrawals could be risky in the decade ahead.

A new study just released from MIT estimates AI capabilities could affect jobs equal to 11.7% of the US labor market, although the number is only 2.2% of jobs thus far.

MIT finds that while only about 2.2% of US jobs have AI-exposed tasks so far, future AI capabilities could touch nearly 12% as adoption spreads.

Source: MIT News

Commentary:

Retirees’ adult children and grandchildren face a changing labor market. Legacy career paths may change quickly. Intergenerational planning is crucial—consider helping family with reskilling or bridging periods of uncertainty, and make sure your own retirement plan is not tied to one sector or employer’s ongoing stability.

There are 654,000 millionaires at Fidelity as of 3Q, which is the highest level in records going back to 2000. Many of these are new 401(k) millionaires. Happy prospecting!

Fidelity’s Q3 report shows the greatest number ever of retirement account millionaires, up from just 412,000 in 2019.

Source: Fidelity Q3 2025 Retirement Analysis

Commentary:

Hitting seven figures in your 401(k) is a landmark, but don’t let the number distract from the fundamentals—sequence of returns risk, withdrawal rate strategy, and tax management. Seek advice to turn your “number” into sustainable, tax-efficient income, and stress test your portfolio for various scenarios.

Recent News: Social Security’s Cost-of-Living Adjustment (COLA) Set at 3.2% for 2025 After Period of High Inflation

The Social Security Administration announced a 3.2% COLA for 2025—down from 8.7% in 2023—amid cooling inflation, but expected healthcare and other retiree expenses may still outpace benefit growth.

Source: SSA COLA Announcement

Commentary:

A lower COLA means Social Security won’t keep full pace with recent inflation surges, especially in healthcare and other essentials. Retirees should revisit their budgets, consider supplementing income through part-time work or investment income, and ensure portfolios include growth assets to hedge longer-term cost increases. Don’t let static income erode your standard of living—proactive adjustments are crucial.

Conversation over—the great wealth transfer has begun. In the past year, 91 people became new billionaires through inheritance.

There are now more new billionaires made by inheritance than by entrepreneurship, as the massive Baby Boomer wealth transfer accelerates.

Source: Fortune

Commentary:

This highlights two things for retirees: The importance of estate planning, and discussing your wishes with family. Passing on wealth tax-efficiently—and aligned to your values—can be the greatest legacy. Don’t let taxes or family strife erode what you’ve built. Update your plan as circumstances and laws change.

In the NFIB November Small Business Optimism report the biggest increase in worry was Higher Selling Prices to 34%—the largest point gain in survey history.

Small businesses are more concerned about high prices than ever before, creating further inflation pressures.

Source: NFIB Small Business Optimism Index

Commentary:

Plan for inflation! Even small increases in costs can erode purchasing power over multi-decade retirements. Budget for healthcare, housing, and services to rise faster than average, and keep some “growth” assets to fight inflation’s impact on your lifestyle.

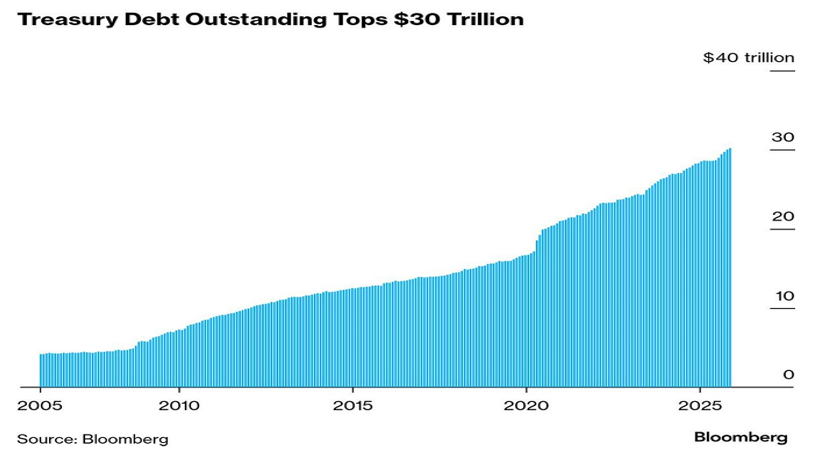

Each bar represents one month going back to 2005. Our treasury debt outstanding tops $30 trillion, showing a smooth line straight up in this chart.

U.S. national debt surpassed $30 trillion in 2024 and continues to climb, reflecting an uninterrupted upward trend since 2005.

Source: U.S. Treasury - National Debt Data

Commentary:

For retirees and those nearing retirement, ballooning government debt can directly impact your future. Higher debt often leads to higher taxes, inflation, and potential Social Security/Medicare changes. Your plan should include strategies to hedge inflation (like TIPS or equities), flexible withdrawal approaches, and proactive tax planning to adapt to changing fiscal policies. Don’t count on historic government safety nets to remain unchanged!

Each bar represents one month going back to 2005. Our treasury debt outstanding tops $30 trillion, showing a smooth line straight up in this chart.

U.S. national debt surpassed $30 trillion in 2024 and continues to climb, reflecting an uninterrupted upward trend since 2005.

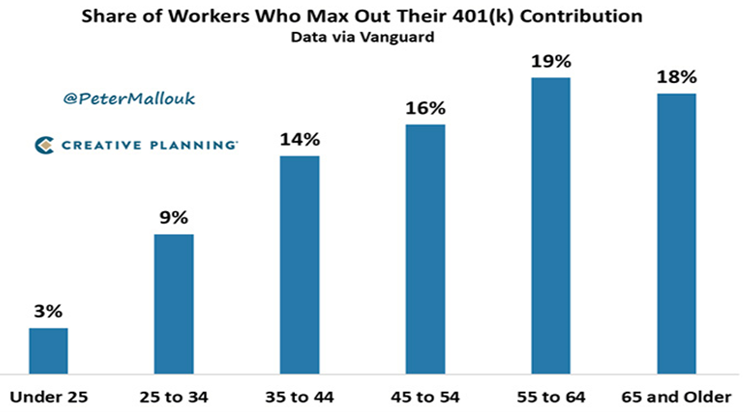

This chart will make you think. 81% of pre-retirement workers (age 55-64) are not contributing what they are allowed.

Most Americans in their peak earning years underfund their retirement accounts, missing valuable tax advantages and compounding.

Source: GAO Retirement Savings Study

Commentary:

If you’re not yet retired, maximize your savings now—especially catch-up contributions. If you’re already retired, encourage children or others you care about to contribute. Procrastination dramatically impacts retirement readiness and flexibility.

Earnings season is ending. Over 80% of S&P 500 companies BEAT earnings expectations, and over 75% beat on revenues.

Big US companies are reporting better-than-expected earnings, signaling strength at the top end of the economy, even as smaller firms struggle.

Source: FactSet Earnings Insight

Commentary:

Strong earnings support stability for portfolios, but don’t take these numbers as a guarantee against volatility. Use these times to rebalance and take profits as appropriate. Make sure your income plan is not overly dependent on permanent outperformance by big companies.

Even with number 1 above, Wall Street is forecasting 14% profit growth for the SP500 in 2026.

Despite some dire long-term forecasts, analysts expect SP500 profits to rise sharply in 2026, showing that market sentiment can change quickly.

Source: Reuters - Earnings Forecast

Commentary:

A key lesson for retirees: The consensus is seldom consistent, so planning should not rely on predictions. Use scenario planning—what if markets disappoint, or surprise to the upside? Your withdrawal rate, spending flexibility, and asset allocation matter much more than headline forecasts.

Final Thoughts

Navigating retirement in this environment comes down to embracing three key practices:

- Diversification of assets and flexibility in planning: The future is uncertain; hedge bets rather than relying solely on one market.

- Ongoing savings and prudent spending: It is never too late to optimize contributions and spending plans—for yourself or guiding loved ones.

- Proactive planning: Address inflation, family legacy, and income volatility so you can make confident decisions, not emotional ones.

The only constant is change—stay informed, keep your plan updated, and your retirement can thrive, rain or shine.