Some interesting ones this week and what a weak it was.

Enjoy.

The Great Stuff Transfer: What Are Heirs to Do with All Their Grantor’s Possessions?

Interesting Fact:

Many families underestimate the complexity of distributing tangible personal property in an inheritance—and it can cause disputes, emotional pain, and logistical nightmares if not addressed.

Source: Fair But Not Equal: Addressing Unequal Inheritance for Heirs | Bragg Financial (2023)

Commentary:

Retirement is about both legacy and lifestyle. As you plan the "Great Wealth Transfer," tangible “stuff” can create emotional rifts if not handled proactively. My advice? Make a plan, be explicit, and, most importantly, communicate clearly with heirs. Consider utilizing a personal property memorandum or even recording videos explaining sentimental items. It’s not about appraised value—it’s about emotional value. Thoughtful planning here will ensure your legacy is remembered with love, not litigation.

The “Cult of Two”: AI Chatbots and Delusional Spirals

Interesting Fact: Intense personal relationships with AI chatbots have led to individuals adopting extreme beliefs, including thinking they’re a god or building a trillion-dollar business—often resulting in social withdrawal or mental distress.

Source: Delusional Chatbot Users Can Spiral Into a ‘Cult of Two’ | Bloomberg (Nov 2025)

Commentary: Retirement means more free time—and often a search for purpose and connection. The rise of AI companions can offer comfort but also a shortcut to isolation or delusion. For retirees, balance is crucial: Use AI for fun and learning, but double down on real-life relationships, hobbies, and volunteering. Longevity thrives on real human connection and grounded engagement with the world.

Who’s Funding the AI Boom? Retirement Money Is Powering the Revolution

Interesting Fact: Insurance companies—major holders of retirement assets—are investing increasing amounts in corporate bonds, particularly those issued by AI tech giants, to support guaranteed income obligations for retirees.

Source: Annual Report on the Insurance Industry (2025), US Treasury (PDF)

Commentary:

Your IRA, 401(k), or pension fund isn’t just paying out—it's shaping the economy. The performance (and risk!) of your retirement income is tied to seismic trends like AI investment. Make sure your retirement income plan includes a mix of stable, inflation-beating, and truly diversified assets. Partner with advisors who understand these macro shifts, and be vigilant, not just for the yield, but for the long-term stability these investments must provide.

Bear Market Recovery: It’s All About the Recession

Interesting Fact: The average time to recover previous highs during a bear market is 81 months if accompanied by recession—but only 21 months if not.

Source: What We’ve Learned From 150 Years of Stock Market Crashes | Morningstar (Dec 2025)

Commentary: Retirees can’t afford to wait 7 years for portfolio recovery. Sequence-of-returns risk is real; withdrawing during downturns can permanently deplete assets. My advice: Always have a safety “bucket” (cash, short bonds) for several years’ spending, so you can survive long recoveries without selling at a loss. Portfolio flexibility—and a cool head—are your best defense.

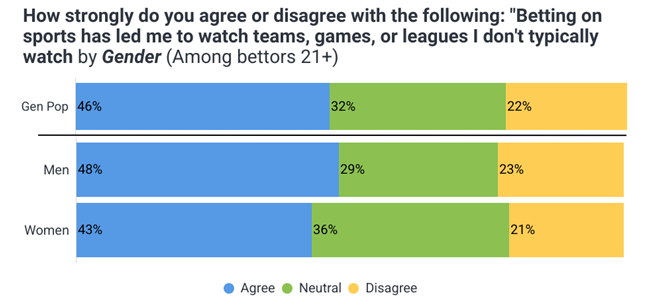

Game On! Sports Betting Habits by Gender

Interesting Fact: Half of U.S. men aged 18-49 have active online sports betting accounts, with significant gender divergence: men far more likely than women to bet and to say betting increases their engagement with teams they’d never otherwise follow.

Source: 22% of All Americans, Half of Men 18-49, Have Active Online Sports Betting Account | Siena College Research (Feb 2025)

Commentary:

Retirement can be a new chapter for friendly wagers…or a gateway to gambling problems. While a little action can spice up the games, recognize it for what it is: entertainment, not investing. Set limits, keep perspective, and never, ever tap retirement funds for bets. Emotional discipline in entertainment habits extends to portfolio habits, too.

S&P 500 Breaks Below Its 50-Day Moving Average

Interesting Fact:

After 139 sessions above its 50-day average, the S&P 500 finally broke below, causing jitters for momentum-following traders but offering long-term investors a valuable perspective on market cycles.

Source: Here’s the message to draw from the S&P 500 falling below the 50-day average for the first time in 139 sessions | Morningstar (Nov 2025)

Commentary:

Technical drops attract headlines but matter less to retirement success than sticking to your plan. The best investors understand that “averages” and “support lines” are more about emotional checkpoints than economic reality. Stay focused on your goals, not market gymnastics, and remember: "timing" almost always works better as "time in."

Know When to Hold ‘Em: The High Cost of Trading Too Much

Interesting Fact: Households who traded the least at a major brokerage outperformed active traders by seven percentage points, after fees.

Source: Trading Is Hazardous to Your Wealth | Barber & Odean, University of California (PDF)

Commentary: Hyperactivity is your portfolio’s silent killer. Most retirees want safety—but can’t resist the urge to “do something.” Remember: inaction is sometimes the winning move. Build a sensible asset allocation and, unless your life changes, let the portfolio do its thing. Restlessness costs more than you think; patience is a superpower in retirement.

Bitcoin ETF Investors Now in the Red: Average Cost Basis Hits $89,000

Interesting Fact: The average cost basis for all inflows into U.S. spot Bitcoin ETFs is around $89,600, and as of late 2025, most investors are underwater.

Source: Bitcoin ETF Investors in the Red After $89,600 Level Breaks | Bloomberg (Nov 2025)

Commentary:

Crypto is the “FOMO” investment of our time—but retirees should approach it like a spicy condiment, not the entrée. If you’ve dabbled, keep your allocation small, and see it as speculative. Don’t let headlines drive major changes—protect your retirement income first, experiment later.

Only 36% of U.S. Millionaires Feel Wealthy

Interesting Fact:

Just over a third of Americans with $1 million or more in investable assets consider themselves wealthy, despite most people believing that’s a “magic number.”

Source: Americans Believe They Will Need $1.26 Million to Retire Comfortably | PRNewswire, Northwestern Mutual 2025 Study (Apr 2025)

Commentary:

Wealth is relative, and “enough” is a moving target. The lesson? Retirement satisfaction isn’t just about portfolio size—it’s about having a thoughtful plan, controlling spending, and nurturing what money can’t buy (health, time, relationships). Focus your retirement planning on freedom and fulfillment rather than chasing arbitrary numbers.

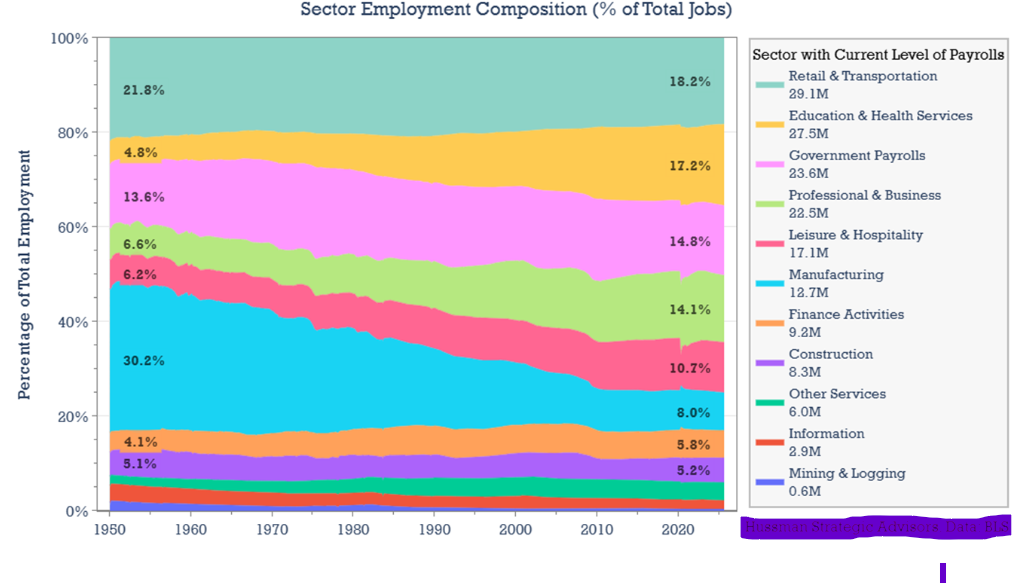

Manufacturing Jobs: From 33% to 8% of Total U.S. Employment

Source: U.S. Supersector Employment Changes from 1950 to 2020 | Stewart (2020)

Commentary:

The world you retired into is vastly different from the one you started in. Lifelong adaptability is the ultimate retirement skill. Stay engaged, keep learning, and don’t be afraid to reinvent what “work,” “hobbies,” and “purpose” mean in this new era. The gig economy, remote work, and lifelong learning options can enrich retirement in ways your parents never imagined.

Final Thoughts: Takeaways

In a world where AI creates new realities, sports betting is everywhere, and even millionaires question their wealth, thriving in retirement requires adaptability, rational planning, and a profound understanding of both financial and psychological well-being. Success in retirement isn’t found in a single hot tip or a perfect market call—it's in the routines, relationships, and resilience you build.

Key lesson?

Keep your retirement plan dynamic, your mind open, and your priorities rooted in what truly matters most. Your legacy will be measured not just in dollars, but in the richness of your relationships, the wisdom of your choices, and the steadiness of your mindset. Thriving in retirement is as much about peace of mind as it is about money in the bank.

Ready to craft a retirement that’s truly yours? Let’s get started!