This Week in Retirement Reality: Economic Facts, Fresh Perspective & Empowering Commentary

WalletHub Ranks the Top States for Retirement in 2026

Fact: WalletHub compares all 50 states on 46 key retirement indicators—from taxes and cost of living to healthcare and fun. The top 5 in 2026:

5. Minnesota

4. Colorado

3. South Dakota

2. Florida

- Wyoming

Source: WalletHub Retirement Rankings 2026

Commentary:

Where you live matters—a lot! But it’s only a starting point. My approach is to bring clarity beyond the rankings. Whether you’re drawn to Florida’s beaches or Wyoming’s wide-open spaces, each state’s “retirement-friendliness” depends on your individual needs and personality. I use practical illustrations to show how taxes, healthcare, and cost of living combine with lifestyle. My job? Ensure your unique path is clear and your options are truly aligned to your goals and comfort.

Job Cuts: A Historic January in 2026

Fact: US companies announced the largest number of job cuts for any January since 2009.

Source: Bloomberg - US Layoffs Surge

Commentary:

Retirement isn’t immune to economic surprises. This news can trigger fears even in those already retired—questions around market stability, portfolio resilience, and even part-time work opportunities. I bring perspective: most news sounds worse than it is, and we build plans flexible enough to weather economic storms. A diversified, tailored retirement income stream helps anchor certainty against employment fluctuations and market volatility.

Home Sale Discounts Hit Highest Level Since 2012

Fact: The average discount for homes sold below their original list price was 8%—the largest since 2012.

Source: Reuters - Home Markets Report

Commentary:

For retirees—whether downsizing, relocating, or gifting property—understanding real estate trends is crucial. I encourage clients to see opportunity in challenging markets: buyers have more leverage, and sellers benefit from realistic pricing. Using clear charts, we make decisions with less stress and more confidence about timing, value, and home equity’s role in your retirement plan.

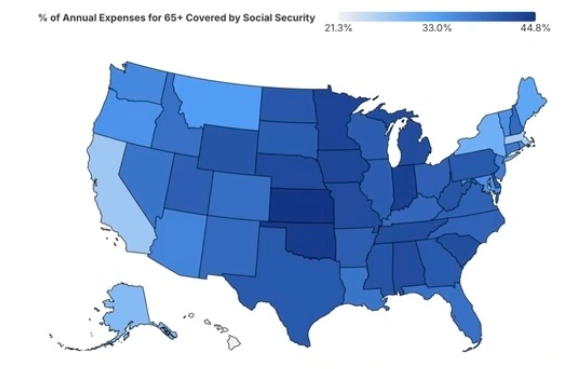

Average Social Security Benefit: $2,071/Month

Fact: The average Social Security benefit nationwide is now $2,071 per month. In some states, this is the largest percentage of annual expenses.

Source: Social Security Administration 2026 Stats

Commentary:

Social Security remains a cornerstone for most retirees’ income. Yet, its role is nuanced: each state’s cost of living shifts the value of that fixed income. I help clients illustrate—using calculators and real-world examples—how Social Security, in combination with other income sources, can be maximized and optimized for their particular needs, so you can thrive, not just survive.

Healthy Consumer & Business Spending

Fact: Mastercard’s earnings call noted “continued healthy consumer and business spending." Similar upbeat comments from Royal Caribbean: “the year is off to a very strong start.”

Source: Mastercard Earnings Release 2026

Commentary:

Consumer confidence drives growth—and shapes retirement lifestyles. Strong spending means stability, opportunity for travel and recreation, and fewer worries about widespread recession. I remind clients that news tends to highlight extremes, but broad spending trends point to an economy that supports your desired freedom and activity.

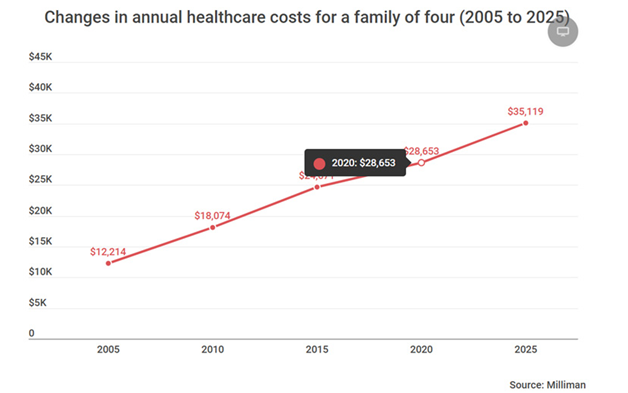

Healthcare Costs: A 20-Year Perspective

Fact: Healthcare costs for a family of four have shifted dramatically over 20 years.

Source: Sun Life Newsroom - Healthcare Trends

Commentary:

Healthcare is one of the biggest unknowns in retirement. With costs rising, planning is more important than ever. I use common-sense illustrations to help you estimate, budget, and understand your options—so you’re prepared for surprises without fear. There are always solutions, and perspective matters: we can plan proactively rather than reactively.

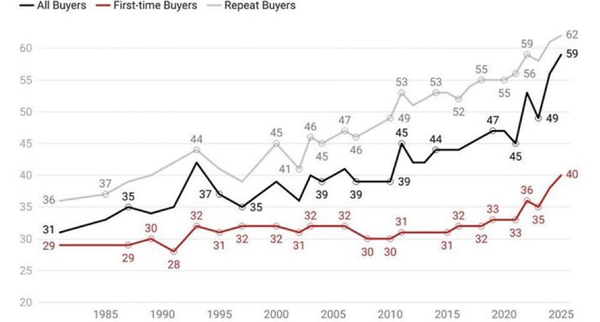

Housing & Age of First-Time Buyers

Fact: The average age of first-time homebuyers continues to rise—reflecting broader economic shifts.

Source: Reuters - Housing and Demographics

Commentary:

Housing decisions in retirement, whether buying, selling, or helping children, are linked closely to market trends. I bring clarity with real-life analogies and practical advice, ensuring your housing strategy fits your unique retirement path.

Life Expectancy: Age 65 Retiree Will Reach 85

Fact: CDC reports the average retiree at 65 will live to age 85.

Source: CDC Life Expectancy Report 2026

Commentary:

Longevity brings joy—and complexity! Planning for a 20+ year retirement means accounting for the unknowns: inflation, healthcare, lifestyle. My practical, common-sense approach is to educate about longevity risks and opportunities, empowering you to take charge of your future, confident your plan is built for the long haul.

Money Can’t Buy Love: Dating Costs in Canada

Fact: A TD Bank survey found 30% of Canadians are going on fewer dates because they’re too expensive.

Source: TD Bank Survey 2026

Commentary:

Retirement isn’t just finances—it’s relationships and joy. I highlight ways retirees can maximize social connections and experiences without breaking the bank. Perspective is key: fun and fulfillment don't have to come with a high price tag.

Super Bowl Betting Frenzy

Fact: Over $800 million worth of contracts tied to the Super Bowl have been traded on prediction markets like Kalshi and Polymarket.

Source: Super Bowl Prediction Market Coverage

Commentary:

Rising popularity of prediction markets highlights both risk and entertainment value. As a financial advisor, I guide clients through the hype with humor and education—reminding them to keep gambling fun, and never confused with investing!

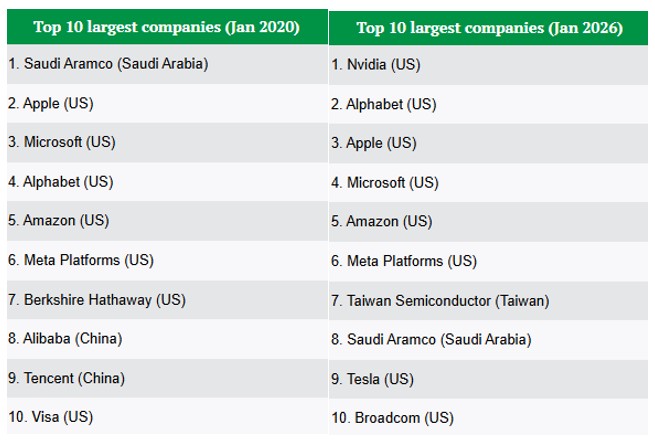

Largest Companies: A 5-Year Shift

Fact: The list of the world’s largest companies has changed dramatically from 2020 to 2026.

Source: ICI Quarterly Update January 2026

Commentary:

Economic and business landscapes shift rapidly. Staying informed and adaptable—while avoiding panic or hype—is key to thriving in retirement. I help clients use practical tools and real examples to see how they can benefit from market evolution, not fear it.

Tech Announcements Signal a Shift

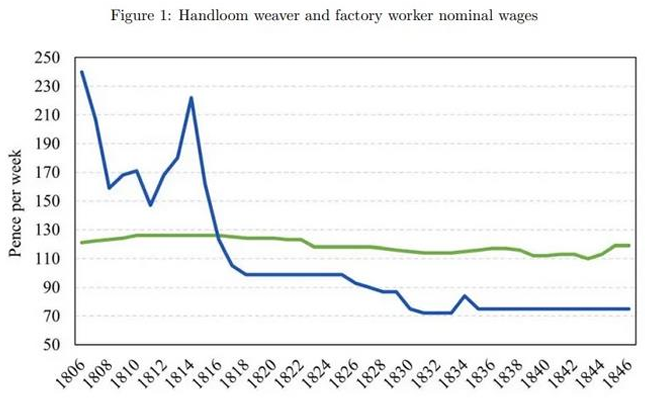

Fact: Two new tech innovations were announced this week, marking a time that will forever change the world—echoing historical waves in how technology reshapes the wage game.

Source: ICI Quarterly Update January 2026

Commentary:

Technology has always been a powerful force in the economy. I offer perspective—new tech shifts often create opportunity as much as challenge. Helping clients see how innovation can enrich, not threaten, retirement is a cornerstone of my educational approach.

Final Thoughts

Retirement is never a one-size-fits-all journey. This week’s headlines—whether ranking states, tracking job cuts, highlighting home discounts, or showcasing Super Bowl betting—remind us that uncertainty and change are always present. My uniquely practical, individualized process ensures you’re educated and empowered with perspective: news is rarely as dire as it sounds, and there are always solutions. By focusing on your unique path, combining common sense and illustrations, and keeping things in laymen’s terms, the unknowns feel less overwhelming and your confidence grows. Together we build a retirement you can truly enjoy, not just endure.