Welcome to 2026!

We’re back in a new year together.

In Chinese zodiac this is the year of the Fire Horse.

Known for innovation, perseverance, and hard strength, but also potential chaos and volatility.

May 2026 be the best year of your life!

Here we go…

Seniors are Overmedicated

Key Data:

- In 2022, 7.6 million seniors were prescribed 8+ medications; 3.9 million took 10+ simultaneously (WSJ, NIA).

Commentary:

Polypharmacy raises the risk of adverse reactions, cognitive decline, and lower quality of life. High-net-worth retirees, who are statistically more likely to access aggressive healthcare, should regularly review all medications with their care team, prioritize "de-prescribing" when possible, and integrate wellness strategies inside and outside conventional medicine. Remember, optimal retirement = vibrant mind + body.

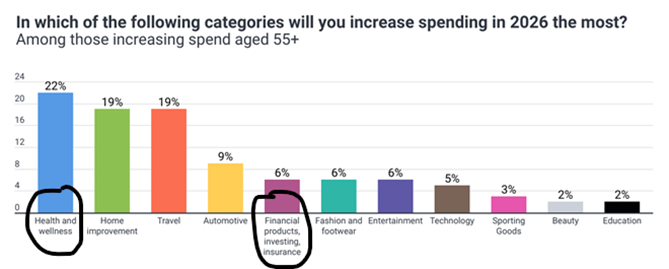

Rising Spend: Health & Wellness Lead for Age 55+

Key Data:

- 36% of Americans 55+ prioritize health/wellness over financial security (55places).

- 2026 will see significant increases in health-related spending, especially among retirees (Paychex).

Commentary:

Expect medical costs to continue outpacing general inflation. Budget proactively for health spending, explore tax-efficient tools (HSAs), and make wellness investments with as much rigor as you would portfolio decisions.

Silver > Oil: Precious Metal Records

Key Data:

- January 2, 2026: 1 oz silver = $71.91; Brent crude oil = ~$62/barrel (Trading Economics, BBC).

Commentary:

Staggering, historic pricing tells us inflation, monetary policy, and uncertainty rule. Should retirees hoard silver? No knee-jerk moves; instead, ensure your portfolio has a logical, diversified allocation to inflation hedges. Precious metals, properly sized, provide optionality and peace of mind.

The Necessity of Annual Rebalancing

Key Data:

Commentary:

Set-it-and-forget-it may be easy, but it’s costly. High-net-worth retirees must rebalance portfolios at least annually to manage risk. Failure to do so leads to unintended risk exposure—and a wealthier retirement is often a safer, steadier one.

Chip Stocks: Nvidia Outpaces All

Key Data:

- Nvidia's 2026 revenue expected to top $300 billion, up more than 10x from 2022 (Nvidia, Yahoo Finance).

Commentary:

Tech is not just for the young! Retiree portfolios benefit from exposure to leading-edge sectors if managed prudently. But beware the hype cycles: focus on lasting fundamentals, avoid speculative chasing, and stick to your investment policy statement.

Digital Currency & Tokenization: China Leads Volume

Key Data:

- China processed 3.48 billion digital yuan transactions by Nov 2025 (The Block, Atlantic Council).

Commentary:

Digital finance isn't a fad. Stay curious: tokenization is transforming everything from real estate to fixed income. Don’t ignore, but don’t rush in blindly. Focus on learning, vigilance, and a healthy skepticism before you move a penny from conventional accounts.

S&P 500 in 2026: Consensus Sees Growth

Key Data:

Commentary:

Predictions are not promises. While a healthy market is encouraging, retirees should anchor to plan: diversify, withdraw with discipline, and stay calm when everyone else forgets past forecasts’ spotty history.

Household Wealth: Top 10% Flourish

Key Data:

- Wealth of top 10% (net worth $2mm+) surged 50% since 2020 (Urban Institute, St. Louis Fed).

Commentary:

If you're reading this, you likely prospered. Use your windfall wisely: update estate plans, review multigenerational gifting, and ensure asset protection. Wealth unlocks opportunity, but only if managed intentionally—not emotionally.

OpenAI: $1.5mm Average Stock Comp per Employee

Key Data:

Commentary:

AI’s value creation is explosive, rewarding those behind the breakthroughs. Retirees: consider private markets, pre-IPO funds, and tech-adjacent alternatives if suitable. But stick to your (well-diversified) knitting—chasing unicorns rarely ends well.

China’s AI IPO Frenzy

Key Data:

Commentary:

The pace and scale are mind-blowing. If you want true global diversification, explore how innovation abroad can play a role in your plan. Beware geopolitical risk and regulatory uncertainty.

Final Thoughts

Retirement is an ever-evolving project, not just a static destination.

Key Takeaway:

- Monitor your health and medications with the same rigor as your portfolio.

- Prepare for rising costs in medical/wellness, not just leisure.

- Leverage new technology but avoid risky speculation.

- Annual rebalancing is your shield against unintended risk.

- Diversification—by sector, geography, and asset class—is your best friend.

- Let your wealth be a tool for family, philanthropy, and ongoing personal growth.

Success for retirees is about balancing confidence, vigilance, adaptability, and purpose. Use data wisely, make decisions logically, and keep a sense of humor—you’ve earned it.

Happy New Year!