Advisors Embrace Alternatives

Fact: In its 2025 Global Advisor Survey, iCapital found advisers are increasingly embracing alternative investments for client portfolios.

Source: iCapital 2025 Global Advisor Survey (icapitalnetwork.com)

Why it matters: As retirees, you rely on stable income streams and diversification to protect your lifestyle. The traditional 60/40 stock-bond model struggled in sustained low interest rates and now in slightly higher rate environments. It is all but dead. More advisers — ourselves included — have eliminated our biases and cleared our blinders. We are always evaluating alternatives like private credit, real estate, structured notes and annuity landscape to complement portfolios and potentially reduce correlation to public markets. This doesn’t mean jumping in wholesale, but carefully allocating a portion to alternatives can enhance income and risk-adjusted returns.

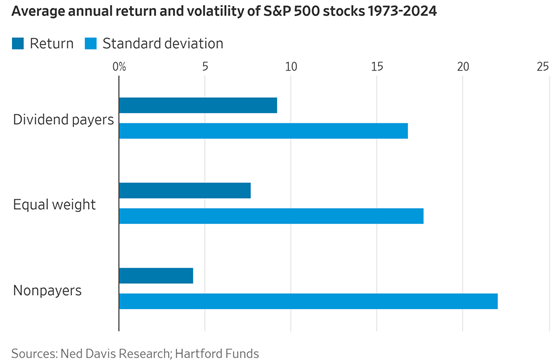

Dividends vs. Non-Payers

Fact: Over the past 50 years, dividend-paying S&P 500 stocks returned 9.2% annually versus just 4.3% for non-payers — with less risk.

Source: Hartford Funds, Ned Davis Research (2023 study)

Why it matters: As retirees, you rely on stable income streams and diversification to protect your lifestyle. The traditional 60/40 stock-bond model struggled in sustained low interest rates and now in slightly higher rate environments. It is all but dead. More advisers — ourselves included — have eliminated our biases and cleared our blinders. We are always evaluating alternatives like private credit, real estate, structured notes and annuity landscape to complement portfolios and potentially reduce correlation to public markets. This doesn’t mean jumping in wholesale, but carefully allocating a portion to alternatives can enhance income and risk-adjusted returns.

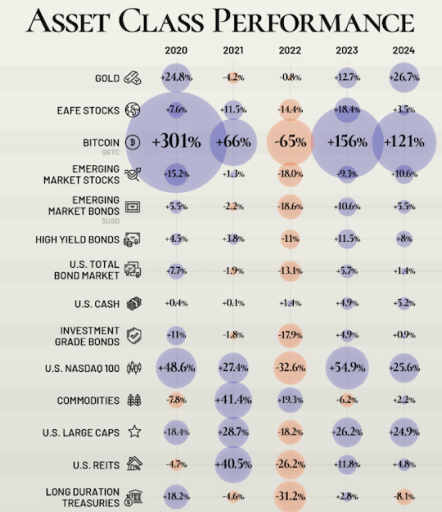

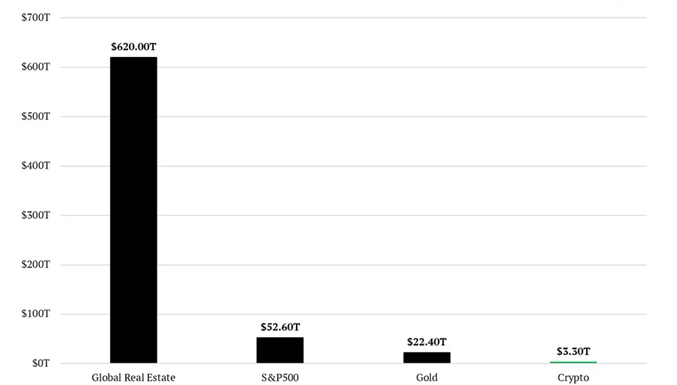

Crypto & Stablecoins

Fact: The crypto market remains small relative to traditional markets despite all the headlines but the performance is hard to overlook…

Source:

CoinMarketCap, approx. $2.5 trillion vs. ~$120 trillion global equity markets.

Why it matters: Yet, look how small the market is to-date... It's easy to be intrigued by charts showing crypto's growth, but most retirees primary goal is preserving wealth. Crypto remains highly speculative and under-regulated. For most clients, if at all, we keep it to a very modest "explore" allocation, recognizing it's still a tiny fraction of global assets.

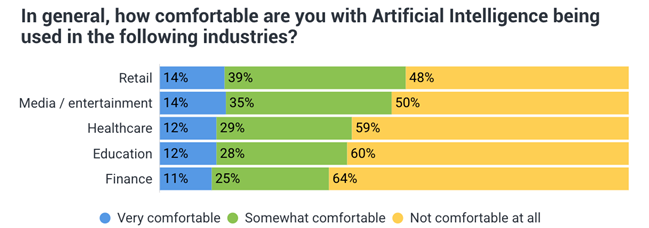

Consumers Least Confident in Finance

Fact: In a recent survey of 1,172 adults, finance was the area respondents felt least comfortable navigating.

Source: CFP Board Consumer Confidence Survey, 2025.

Why it matters: This is exactly why we do what we do. Many of you have been highly successful in business or your professions, but the retirement phase — converting assets into reliable income and navigating taxes, health care costs, and estate plans — is a different ballgame. You’re not alone if it feels overwhelming.

Amazon’s Humanoid Workforce

Fact: Amazon now has over 1,000,000 robots working alongside humans in its warehouses.

Source: Amazon Q2 2025 earnings release.

Why it matters: This illustrates the ongoing push for automation, which affects inflation, wage growth, and investment opportunities. As investors, we monitor companies leveraging AI and robotics because they can drive profitability — which ultimately supports your stock portfolio values.

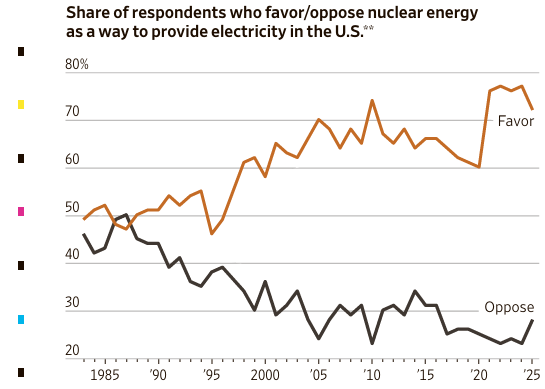

The Energy Cost of AI

Fact: The average ChatGPT query consumes ~0.35 watt-hours of electricity.

Source: Ars Technica, 2024

Why it matters: AI’s energy needs are reshaping demand for power — and investments tied to infrastructure, data centers, and even utilities. We’re watching how this might influence inflation and long-term costs, which matter to your purchasing power.

Retirees & Debt Concerns

Fact: A survey of 3,600 retirees aged 62+ found 68% had credit card debt; 31% said their spending exceeds what they can afford. Some advisers are even asking clients to sign letters acknowledging spending warnings.

Source:

J.D. Power Retirement Spending Survey, 2025

Why it matters: It’s a cautionary reminder that retirement isn’t just about investment returns — it’s also about prudent spending. We run detailed cash flow plans with you to help avoid surprises that could erode your nest egg. Keeping debt low is critical to maintaining flexibility.

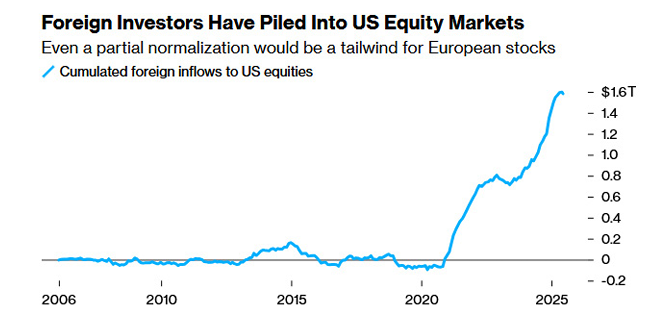

U.S. Markets Remain Open

Fact: Despite geopolitical tensions, at least one U.S. border stays wide open — equity markets continue to attract foreign capital.

Source: Bloomberg, July 2025.

Why it matters: This underpins the relative strength of the U.S. market. Even with our debt challenges, global investors still view the U.S. as a primary destination. That supports stock valuations, which is good news for your portfolio.

Investor Sentiment Stretching

Fact: The AAII weekly survey shows bullish sentiment rose to 45%, the highest since January.

Source:

American Association of Individual Investors, July 2025.

Why it matters: We track sentiment because extreme optimism can signal caution. While 45% isn’t euphoric, it tells us to stay balanced — not get swept up chasing hot trends that could reverse, protecting your wealth in uncertain markets

Rise of the “Boomeranger”

Fact: 35% of new hires today are returning former employees, known as “boomerangers.”

Source:

LinkedIn Workforce Insights, June 2025.

Why it matters: It’s a sign that employers prioritize known talent in uncertain times. This stable job market continues to support consumer spending and corporate profits — helping drive the dividends and earnings that underpin your investments.

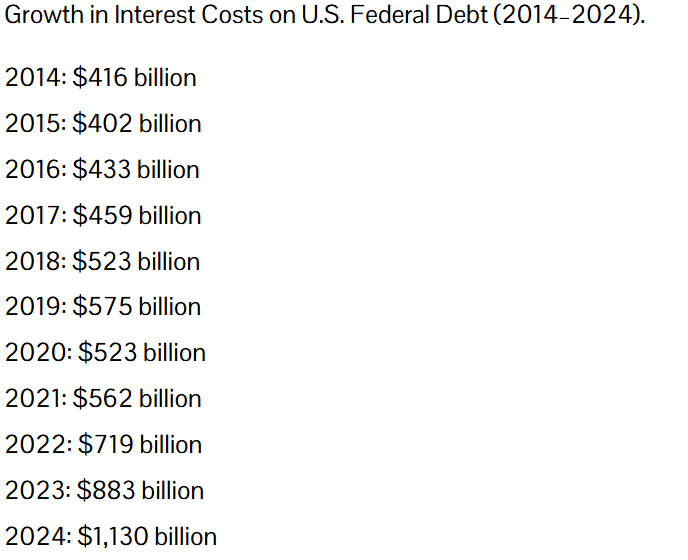

Cost of U.S. Debt

Fact: Interest on the national debt now exceeds $1 trillion annually, growing faster than most budget categories.

Source: Congressional Budget Office, 2025.

Why it matters: Rising government debt could pressure future tax policy. This is why we continually look at tax-efficient withdrawals, Roth conversions, and estate strategies to help shield your wealth from potential future tax hikes.

Tariffs Hit Midsize Firms

Fact: JPMorgan Chase Institute found midsize U.S. companies face $82 billion in new tariff-related expenses.

Source: JPMorganChase Institute 2025 Tariff Impact Report.

Why it matters: Tariffs ripple through costs, margins, and ultimately to your stock holdings and consumer prices. It’s a reminder of why we diversify across sectors and geographies, helping cushion unexpected policy impacts.

IPO Slowdown

Fact: Just 27 venture-backed companies went public in the first half of 2025 — the fewest in a decade.

Source: PitchBook Q2 2025 IPO Report.

Why it matters: A quieter IPO market reflects tighter capital conditions. This can be good for established, profitable companies (which we typically overweight in retiree portfolios) but also means we watch for bargains if valuations reset.

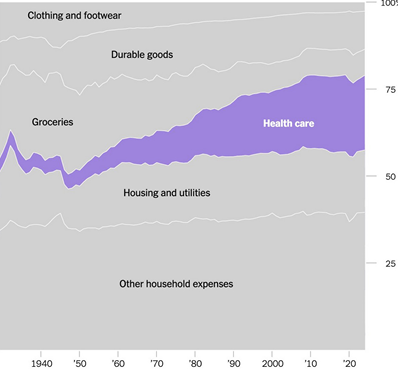

Health Care Now Exceeds Housing

Fact: Americans now spend more on health care than either groceries or housing.

Source: Bureau of Economic Analysis, July 2025.

Why it matters: Rising medical costs directly threaten retirement plans. We build health care inflation into your projections and explore options like long-term care planning, so you don’t have to scale back your lifestyle later.

Nvidia at $4 Trillion

Fact: Nvidia’s market cap hit $4 trillion — roughly 3.6% of total global GDP by itself.

Source: Bloomberg, July 2025.

Why it matters: This underscores how concentrated market gains are in a handful of companies. While we like innovation, we diversify beyond just mega-cap tech to avoid outsized risk from a single sector impacting your entire retirement nest egg.

✅ Final thought:

It’s a complex world with evolving risks — from national debt to AI energy needs. The good news is with careful planning, diversified investing, and proactive tax strategies, we can position your wealth to fund your lifestyle no matter how the headlines read.