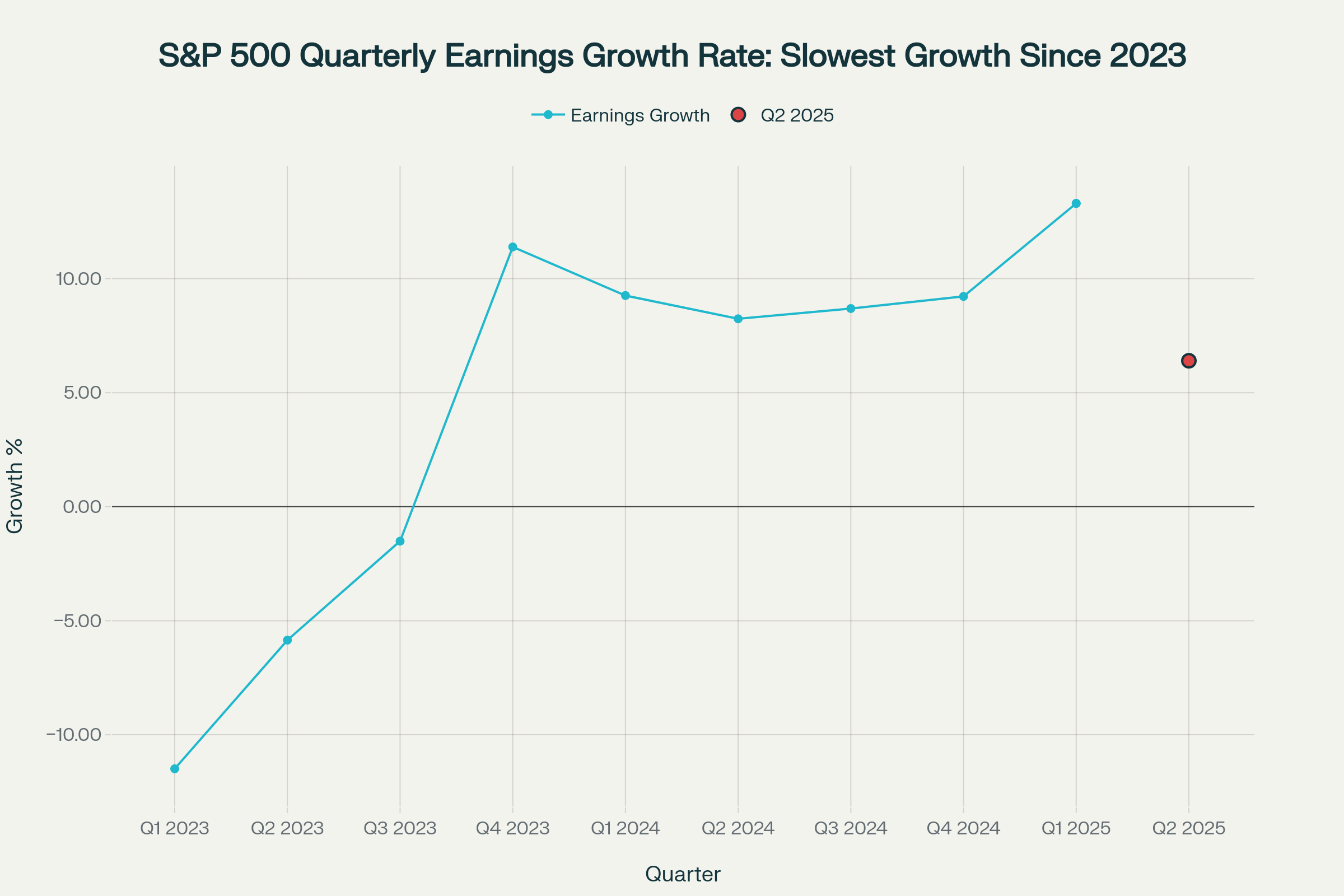

Earnings Growth Slowing

Fact: S&P 500 companies are projected to post the slowest quarterly earnings growth since 2023, reflecting the impact of higher input costs.

Source: FactSet Earnings Insight, July 2025

Why it matters: When companies absorb inflation rather than passing it on, it helps consumers in the short term but erodes corporate profit margins. As an investor, it’s critical to focus on earnings quality over short-term market highs. This environment rewards companies with pricing power and strong balance sheets.

Tariffs Equal to Corporate Tax Hikes

Fact: A proposed 15% blanket tariff could raise about $500 billion—nearly doubling the annual revenue collected from corporate taxes in the U.S.

Source: Tax Foundation, Congressional Budget Office, July 2025

Why it matters: Tariffs are indirect taxes on consumers and investors, and, if enacted, could both squeeze corporate profits and raise prices. Diversifying across U.S. and international markets can help manage these kinds of policy risks.

Wealth and Strength Training

Fact: Long-term strength training reduces the risk of cardiovascular disease, diabetes, and cancer, lowering early death risk by 10%–17%.

Source: British Journal of Sports Medicine, July 2025

Why it matters: Health and wealth are interconnected. Clients who focus on physical health incur lower medical costs, sustain higher activity in retirement, and have greater flexibility in lifestyle choices.

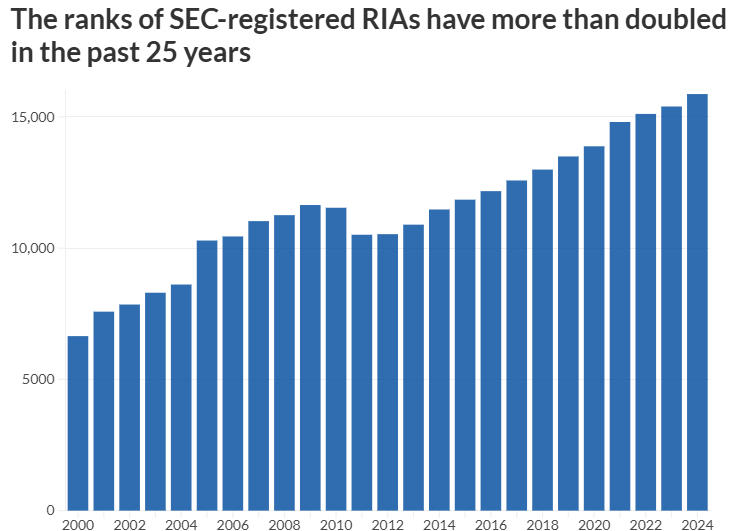

Record RIA Growth

Fact: SEC-registered independent advisory firms have added over 22 million new clients in the past six years, setting an all-time record.

Source: Investment Adviser Association, 2025 Trends Report

Why it matters: More investors now seek fiduciary, client-aligned financial advice. The scope of advisory continues to grow beyond investments into areas like income strategies, estate planning, and legacy optimization.

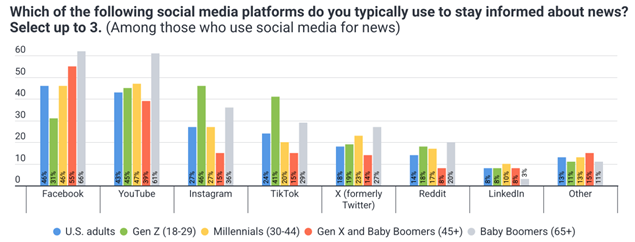

Social Media as a News Source

Fact: Adults ages 50–75 are increasingly turning to social media to consume financial and economic news.

Source: Pew Research Center, July 2025

Why it matters: The prevalence of misinformation and sensationalist headlines on platforms like YouTube and Facebook makes trusted professional guidance more valuable than ever.

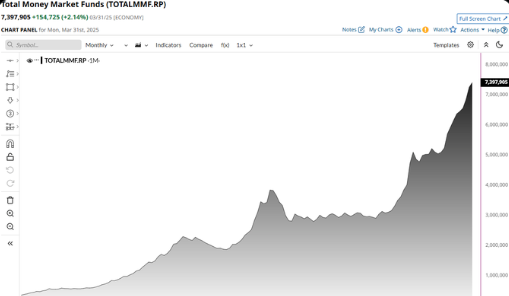

$7.4 Trillion in Money Markets

Fact: Money market fund balances have reached a record $7.4 trillion.

Source: Investment Company Institute, July 2025

Why it matters: This unprecedented cash buildup signals caution among investors but also signals opportunity. Evaluating if your cash is earning enough and fits within your strategy is essential as short-term yields fluctuate.

College Grad Unemployment Surges

Fact: For the first time in 45 years, unemployment for college grads (5.8%) now exceeds the national average.

Source: Bureau of Labor Statistics, June 2025

Why it matters: This could be an early indicator of weakness in the labor market. From a portfolio perspective, it underscores the value of prioritizing companies with stable, resilient earnings.

Advisor Satisfaction Rankings

Fact: The top firms for advisor satisfaction in 2025 are Commonwealth, Stifel, Raymond James, Edward Jones, and Cambridge.

Source: J.D. Power U.S. Financial Advisor Satisfaction Study, 2025

Why it matters: High advisor satisfaction correlates with stronger client service. As an independent team, we benchmark these rankings to ensure your interests always come first.

Top 10% of Earners Drive Spending

Fact: 10% of wage earners now account for 50% of all U.S. consumer spending; 61% of consumers are “trading down” from name brands.

Source: BofA Global Research, July 2025

Why it matters: This economic bifurcation requires careful portfolio construction. Companies catering to affluent consumers may prove more resilient in an uneven economy.

Markets Keep Climbing

Fact: The S&P 500 hit its ninth all-time high of 2025; crypto market capitalization surpassed $4 trillion.

Source: Bloomberg, July 22, 2025

Why it matters: While record highs often inspire confidence, not all assets are priced fairly. Fundamentals and income remain central to long-term portfolio health, with crypto treated as a speculative—not a core—holding.

Health Insurance Rate Shock

Fact: Blue Cross Blue Shield of Illinois requested a 27% rate hike for 2026 plans; Texas plans seek a 21% increase.

Source: Kaiser Family Foundation (KFF), July 2025

Why it matters: Health care inflation remains a major threat to retirement sustainability. Planning for rising costs, and exploring supplemental and long-term care solutions, is essential.

AARP Dementia Hub Launches

Fact: AARP created a “Dementia Hub” to help advisors and families address cognitive decline, featuring anti-fraud tools like BankSafe.

Source: AARP Dementia Resource Hub, July 2025

Why it matters: The risk of cognitive decline increases with age. Our commitment to clients includes putting safeguards and proactive plans in place well before critical decisions become urgent.

✅ Final Takeaway:

These developments underscore a rapidly changing investment and retirement landscape. Navigating it successfully requires diversified strategies that blend growth, income, and protection against both economic shocks and evolving risks. Together, we help you make confident decisions for your income, lifestyle, and legacy—no matter what the headlines say tomorrow.