The Magnificent Seven are spectacular companies with soaring revenues and profits. But they are priced for perfection. As of the end of 3Q they were worth over $20 trillion which is more than the entire Chinese stock market.

- Interesting Fact: The combined values of the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla) now surpass the GDP of China and the value of its entire stock market.

- Source: ETF Trends

- Commentary: As a retiree or near-retiree, it’s crucial to realize that “priced for perfection” means these stocks offer little margin for error. These enormous valuations reflect immense optimism—but also risk. If even one company slips, sharp corrections could occur. Diversification is vital; don’t stake your retirement on sector stars alone. Remember, preserving principal and steady withdrawal rates is more important than chasing glamour.

What a 180 from Electric Vehicles. Ford’s Lincoln Navigator is having its best year since 2007 and Cadillac’s Escalade is on track for its best year since 2003.

- Interesting Fact: Luxury SUVs are seeing their best sales numbers in over a decade, defying recent trends favoring EVs.

- Source: Lincoln Navigator - Lincoln, Cadillac Escalade - Wikipedia

- Commentary: Consumer preferences can shift dramatically, sometimes quickly enough to disrupt entire industries. Retirees should keep vehicles and related investments (for example, car stocks, REITs with auto tenants, etc.) flexible and adaptive. Don’t bet your portfolio on one technology or trend—spread your eggs across baskets, because even dominant stories like EVs aren’t a sure thing. This also speaks to not being swept up in “forever trends”—things change!

Literally Off the Chart

- Interesting Fact: The Citigroup Panic/Euphoria model is deep in “euphoria” territory, a level historically associated with over-bullishness and market risk.

- Source: Barron’s Market Lab

- Commentary: For retirement investors, high euphoria usually precedes a sharp drop or heightened volatility. This is textbook “irrational exuberance,” and classic retirement advice is to avoid getting greedy at market tops. Your focus should be capital preservation and sustainable income, not “home runs.” Now is a great time to review how much risk you are really taking across all assets.

While consumer spending on services is holding steady, the movement of physical goods has ground to a halt. 2025 freight demand has nosedived dropping to levels not seen since the lows of the pandemic.

- Interesting Fact: Freight demand for goods has plunged to pandemic-era lows, even as service spending remains robust.

- Source: McKinsey

- Commentary: This dichotomy indicates underlying economic instability. For retirees, slowing goods movement signals inflation, job risks, and potential portfolio volatility—especially if you depend on logistics, shipping, or manufacturing sectors. Shift allocations toward service-oriented or defensive assets when you see these trends, and remain vigilant for consumer spending pivots.

More home purchase agreements were cancelled in September to the tune of around 15% of contracts. This is up from around 13.5% last year. Uncertainty around the economy and anxiety over jobs were two of the top reasons why.

- Interesting Fact: 15% of home purchase contracts were cancelled in September 2025, hitting a recent high due to economic uncertainty.

- Source: Morningstar

- Commentary: Housing is a pillar asset for most retirees. When cancellation rates rise, it’s a sign of buyer caution and potential price softness. If you’re selling property, be flexible and prepared for deals falling through. If buying, negotiate hard—this is a “buyer’s market.” For those living off real estate income, consider contingency plans or alternative rental strategies.

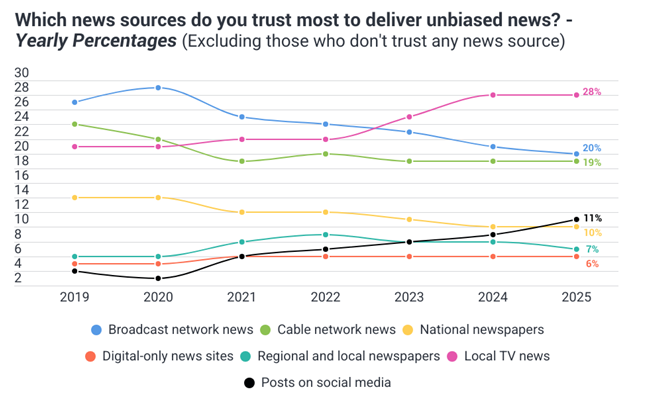

Which news sources do you trust most to deliver unbiased news? Yearly percentages excluding those who don’t trust any news sources.

- Interesting Fact: No single news source is trusted by a majority, with polarization stronger than ever; the AP and AllSides are among the most cited for neutrality.

- Source: YouGov, Pew Research

- Commentary: Retirement decision-makers must cut through the noise. With so much bias, diversify your information sources as you would your investments. Seek out original data, professional analysis, and non-partisan fact checkers when making choices about markets, taxes, or health care.

Bitcoin broke its 200-day moving average. The next reliable support level is around $94,000.

- Interesting Fact: After falling below its 200-day moving average, Bitcoin’s next strong historical support is near $94,000.

- Source: Investopedia

- Commentary: While crypto is intriguing, its volatility makes it a risky asset for those drawing income in retirement. If you hold bitcoin, establish clear percentage limits within your portfolio and be aware of technical indicators to avoid catastrophic loss. Never let “speculative” assets drive your overall retirement (unless you’re truly comfortable with the risk!)

Corporate lenders are increasing due diligence in the wake of recent alleged fraudulent loans. Lenders are inserting conditions that permit them to do more frequent checkups and demanding longer history of financial data. This should positively impact the insurance industry and its investment portfolios.

- Interesting Fact: Lenders now perform more frequent reviews and require more documentation, improving quality and lowering risk in the insurance-investment sector.

- Source: S&P Global

- Commentary: For retirees who invest in, or rely on, insurance products (annuities, whole life, pension funds), this is good news. Enhanced lending standards improve the stability and safety of long-term investments. Providers become better risk managers, reducing default risk and policyholder surprises.

YouTube grabbed over 12% of ALL TV viewership in September.

- Interesting Fact: YouTube alone accounted for more than 12% of American TV viewing, dominating streaming platforms.

- Source: Statista

- Commentary: For retirees, this is more than entertainment. It’s an opportunity—YouTube is now a rich source for financial education, travel tips, health content, and social connection at any age. Consider using YouTube strategically for lifelong learning, hobby communities, and staying “plugged in.” Just watch out for misinformation and always verify sources!

Not terrible, but hardly good, as one analyst put it. Technicians point out there is no technical or internal weakness (currently) in the SP500 ex-AI capex. Remember 1999 – everything was breaking down long before the Spring 2000 collapse.

- Interesting Fact: 56% of S&P 500 stocks are above the 200-day moving average, signaling resilience—but not all-out strength.

- Source: Morningstar

- Commentary: Technical indicators like the 200-day average are important barometers for retirees. While “no sign of weakness” comforts, markets can change quickly. Use this information to check portfolio trends and rebalance when leadership narrows too much—especially if your allocation is heavy in recent “winners.”

Final Thoughts: Thriving in Retirement

The golden thread running through all these news items is the necessity for a disciplined, balanced approach—the very foundation of thriving in retirement. Here’s how:

- Diversification remains your moat against market swings—from tech overvaluation, turning automotive tides, and housing-market jitters to the ever-shifting crypto landscape.

- Risk Management is critical, especially with market euphoria, volatility warnings, and sector rotations. Don’t chase the latest trends; set guardrails for your spending, withdrawals, and investment allocations.

- Flexibility and Adaptability matter. Economic trends can change abruptly. Whether that's shifts in consumer spending, dramatic industry reversals, or regulatory changes in lending, stay nimble with your financial plan and your lifestyle choices.

- Information Integrity—just like your investments, your sources of information should be broad and balanced, not siloed or biased. Use multiple perspectives to make the best decisions for your health, wealth, and happiness.

By staying vigilant, logical, and open to change, you not only preserve wealth but also maximize fulfillment during your retirement years. That’s the real Magnificent Seven—security, freedom, purpose, learning, connection, health, and joy!