Open for business!

Over the past 50 years the market has been higher 65% of the time by an average of 3% two months after a government shutdown ended.

Here we go…

LPL Advisor Growth Study: Four Things Successful Advisers Do

Interesting Fact:

The LPL Advisor Growth Study found top advisors: establish growth priorities, segment clients, deeply serve clients with tailored planning, and use data to acquire clients.

Source:

LPL Growth Study

Commentary:

Retirees should seek advisors who build a plan around your

needs, use data to personalize strategies, and proactively initiate insightful conversations, not just react to your questions. A retirement plan is a living document—an advisor who applies these four principles can truly help you evolve and thrive as markets, tax laws, and your life change.

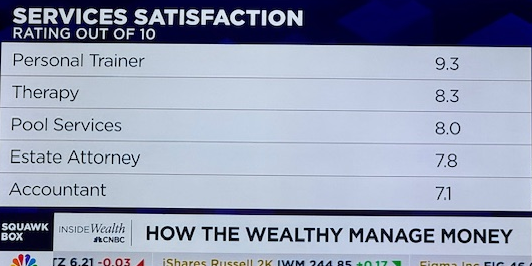

Service, Service, Service: Millionaires Love Personal Trainers, Not Expensive Advisers

Interesting Fact:

20% of high-net-worth individuals plan to fire their adviser due to high costs and poor service, while personal trainers score a 9.3/10 in satisfaction.

Source:

CNBC - Millionaires value trainers over advisors

Commentary:

The lesson for retirees is that your relationship with a financial adviser should be as personalized and results-focused as your schedule with a fitness trainer. If your adviser isn’t “serving” you—checking in routinely, customizing advice, and charging fair fees—fire them! Retirement is your personal marathon, and only the best coaches deserve a place on your team.

US Employers Cut Hiring Pace by 35% Year-over-Year

Interesting Fact:

The lowest year-to-date hiring since 2011, with job cuts surging 175% YoY in October.

Source:

Challenger October Report

Commentary:

Slower hiring signals economic uncertainty—something retirees need to consider when reviewing their investment allocations. If fewer jobs are created, expect pressure on consumer spending and real estate. Reducing risk in volatile sectors and maintaining ample liquidity is wise during such times; this is defensive play at its best.

No Hip-Hop in the US Top 40 for First Time Since 1990

Interesting Fact:

The Hot 100 chart has no hip-hop entries for the first time in 35 years.

Source:

Billboard

Commentary:

This cultural shift demonstrates how quickly tastes and trends can change, even after long periods of dominance. Retirees should remember that “trend investing” can be precarious—practices or sectors that seem timeless may fade unexpectedly. Keep your investments diversified and avoid overexposure to what’s “hot” right now.

1.2 Million Show Emotional Attachment to ChatGPT Models

Interesting Fact:

OpenAI reports that over 1.2 million people have formed strong emotional attachments to AI chatbots.

Source:

Platformer

Commentary:

Technology is becoming more integrated into daily life—even emotional life. Retirees can use this to their advantage for learning, companionship, and information, but should beware of overreliance. Balance digital connections with real-world interactions; healthy emotional habits translate into better decision-making in retirement.

Air Travel Nightmares Loom as 15-20 Air Traffic Controllers Retire Daily

Interesting Fact:

With government shutdowns and retirements, air traffic controller shortages are disrupting travel—and threatening more delays.

Source:

The Hill

Commentary:

Retirees who travel for pleasure or to visit family must remain flexible with plans. Use travel insurance and build buffer time into itineraries. Also, recognize how labor shortages in any sector signal broader economic risks. Plan ahead for rising costs and disruptions beyond the airport—from hospitality to healthcare.

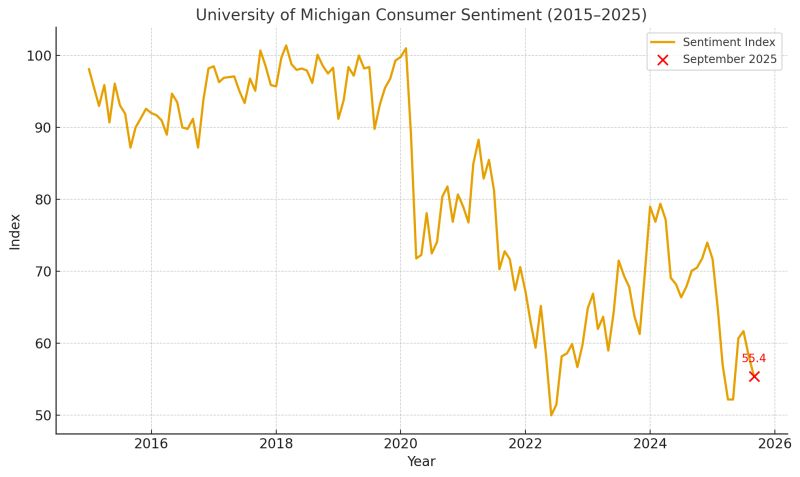

Consumer Sentiment Near Historic Lows

Interesting Fact: Consumer confidence indexes in November 2025 are sitting close to multi-decade record lows.

Source:

Conference Board

Commentary:

Market psychology drives returns and spending patterns. Retirees should avoid panic but also weigh whether now is the time for big purchases or aggressive investing. Low sentiment can precede market rebounds—or more trouble. Maintain discipline: stick to your spending plan, update financial goals, and reduce risk if market noise makes you uneasy.

NFIB Small Business Optimism: Labor Quality Jumps as Chief Concern

Interesting Fact:

In October, 27% of small business owners cited labor quality as their top issue, up 9 points month-over-month.

Source:

NFIB

Commentary:

If you own a business, poor labor quality affects both your profits and your exit plan. For retirees, it means economic growth may be compromised, potentially impacting local economies and investment returns. If you're considering selling a business or property, factor in labor market risks when setting your price and timing your exit.

S&P 500 Operating Earnings Up Over 19% YoY

Interesting Fact:

S&P 500 companies report an average 19% gain in operating earnings, signaling strength in large-cap, diversified firms.

Source:

FactSet Earnings

Commentary:

Retirees benefit from exposure to stable, profitable companies—especially in periods of sector unevenness. Don’t ignore the role of blue-chip stocks in preserving and growing wealth. Reinvest dividends, and periodically rebalance if your allocation drifts too far toward riskier assets. Strong earnings help “pay the bills” for your retirement paycheck.

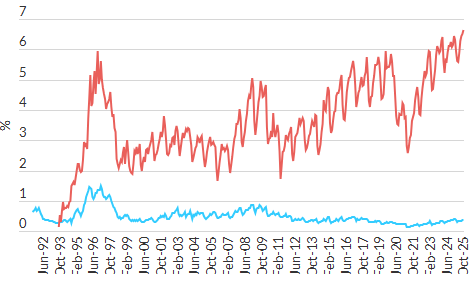

Subprime Auto Loan Delinquencies Hit Record Highs

Interesting Fact: 6.65% of subprime car borrowers are 60+ days delinquent—the worst rate since 1994.

Source:

Bloomberg

Commentary:

A rise in delinquencies is a red flag for economic health; risky debt default can quickly spread to other sectors. Retirees should review credit and fixed-income exposure. If you lend money or invest in consumer credit products, double-check risk levels. Prioritize capital safety and avoid yield chasing when warning lights go on.

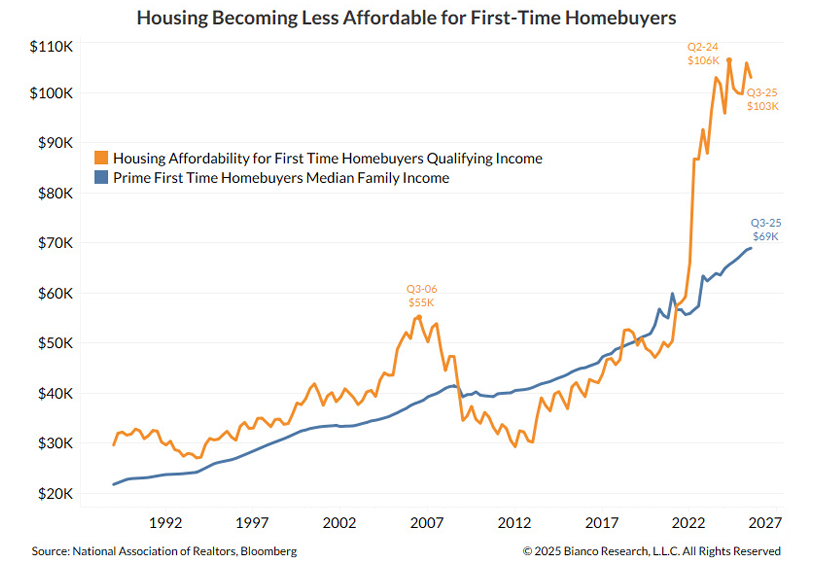

Renting Grows Among Next Generations as Homeownership Drops

Interesting Fact: Homeownership is increasingly out of reach for first-time buyers, pushing younger generations toward renting.

Source:

Freddie Mac

Commentary:

Today's retirees might own multiple properties—valuable, but illiquid. Rising rents boost cash flow for landlords but may reduce property demand and liquidity. Consider downsizing or selling while demand (for rentals) is strong. Leave room for flexibility as family housing needs shift.

Treasuries Outperform Bitcoin in 2025

Interesting Fact: In 2025, US Treasuries beat Bitcoin returns; only a handful of altcoins outperformed the benchmark.

Source:

IMF Crypto Assets Monitor

Commentary:

The “slow and steady” sometimes wins the race! Retirees tempted by high-flying crypto markets should note Treasuries’ low volatility and dependable yield. Crypto is speculative and should be a small (if any!) piece of a conservative retirement portfolio. Stability is your dividend.