US Inflation Accelerates Modestly

September CPI up 3% year-over-year, mainly due to rising food and utility prices. Core inflation remains tame.

Source: Deloitte Insights

Commentary:

Even modest inflation is a powerful force in retirement planning. For those with significant assets, the greatest risk isn't just sudden spikes but the slow erosion of purchasing power over decades. Keeping an eye on specific expense categories, like food and utilities, helps refine withdrawal rates and budget forecasts. Inflation-linked bonds and real assets (like real estate or infrastructure) are increasingly vital holdings to buffer against rising living costs without sacrificing lifestyle quality.

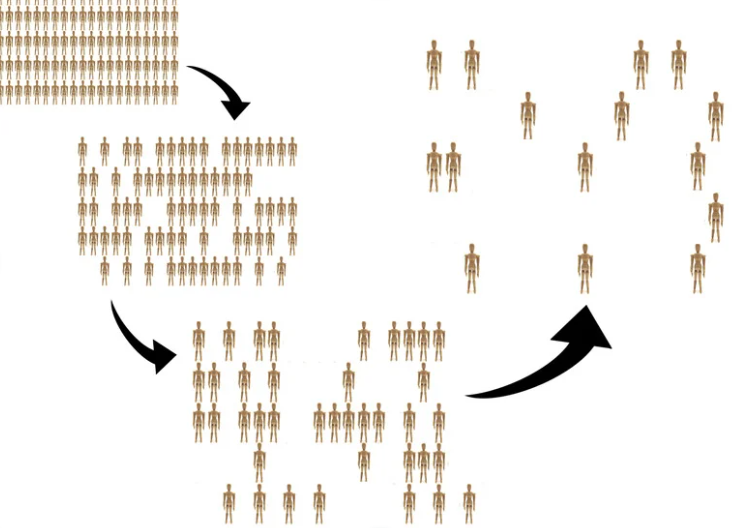

US Population Projected to Decline in 2025

Net immigration has turned negative; possible population decrease this year, with longer-term worker shortages looming.

Source: Deloitte Insights

Commentary:

A shrinking population, especially among working-age adults, means fewer workers supporting retirees, significant implications for entitlements, and higher costs in labor-intensive sectors like healthcare and home maintenance. For well-funded retirees, this highlights the wisdom of prioritizing investments in automation, robotics, and healthcare services poised to benefit from labor scarcity. It’s also a prompt to assess long-term care plans and provider networks more closely.

Sharp Increase in Utility Prices

Electricity prices up 5.1%, natural gas up 11.7% year-over-year, driven by datacenter demand and energy policy shifts.

Source: Deloitte Insights

Commentary:

For people living off their assets, fixed costs like utilities can eat into budgets more than anticipated—especially for those with larger properties or secondary homes. This trend reinforces the need for energy-efficient housing, re-evaluating locations, and even considering direct investments in sustainable energy to lock in lower long-term costs. Utility stocks and funds that benefit from green energy trends also stand out as attractive diversification candidates.

Meat Prices Climb 8.5% on Production Disruption

Farm labor shortages from immigration policies have disrupted the supply chain.

Source: Deloitte Insights

Commentary:

Food inflation can make even luxury spending feel pinched. For retirees, it's a lesson in flexibility and proactivity—stocking up strategically on staples, leveraging loyalty programs, and considering alternative diets. From an investment standpoint, consumer staples companies often outperform in inflationary cycles, making them solid candidates for defensive allocation and reliable dividend income.

Health Works Leaders Coalition Launched

WHO, World Bank, Japan formed coalition to mobilize health system investments, targeting 1.5 billion people by 2030.

Source: WHO

Commentary:

Major investments in global health infrastructure could reduce costs and improve availability of advanced treatments worldwide. For retirees, this can translate to better access and lower costs for elective care abroad or within the US. Investors should explore global healthcare, biotech, and related ETFs for low-correlation, long-term growth potential rooted in real societal trends.

China’s Economy Decelerates

Q3 GDP up 4.8% year-over-year; property investment down 13.9%. Retail sales slow and home values fall.

Source: Deloitte Insights

Commentary:

China’s slowdown is a caution signal. Retirees with global portfolios need to rebalance regularly and not overcommit to markets with structural uncertainty. Focus on multinational firms with robust supply chains and broad exposure—the world economy increasingly rides on adaptability and risk management.

Japanese Exports Rebound Despite Tariffs

September exports up 4.2% year-over-year, but US-bound auto exports down 24.2% due to tariffs.

Source: Deloitte Insights

Commentary:

Tariffs can unsettle entire industries, yet agile economies find ways to adapt. This highlights the importance of owning international mutual funds and ETFs with dynamic management that actively shift allocations according to global policy changes. Such strategic diversity shores up retirement savings against sudden shocks.

British Core Inflation Eases

UK core CPI up 3.5% in September, unchanged month over month; signals potential policy easing ahead.

Source: Deloitte Insights

Commentary:

Cooling inflation overseas often means monetary stimulus, which can lighten currency risks and boost overseas asset values for dollar-based investors. Retired investors should take advantage of global diversification and watch for emerging opportunities in fixed income, especially as rates fall abroad.

Health Financing Expertise on the Rise

Japan introduces UHC Knowledge Hub to train policymakers in health financing and reform.

Source: WHO

Commentary:

Smooth-running health systems make universal coverage more realistic, curbing out-of-pocket costs and improving outcomes. For international investors, aligning with funds tied to public health advances can yield both financial returns and social impact, creating a legacy along with income.

US Labor Market Weakness Supports Rate Cuts

Fed may cut rates further, citing slow employment growth.

Source: Deloitte Insights

Commentary:

Every retiree is, in effect, a "fixed income investor." Falling rates help support asset prices—good for wealth—and lower borrowing costs, but can shrink future yields for new bond purchases. For most, this calls for laddered bond strategies and increased attention to higher-yielding but quality dividend stocks for income.

Service Inflation Remains Steady

US service prices up 3.6%—lowest in 4 years.

Source: Deloitte Insights

Commentary:

Services from home repairs to healthcare are often underappreciated budget line items. Today's steady service sector inflation means retirees can better anticipate expenses, providing some certainty for long-range withdrawal rate planning and annuity purchases that account for cost-of-living adjustments.

Global Health Investment Spurs Job Creation

Coalition health reforms expected to create jobs via pharma partnerships in Mexico.

Source: WHO

Commentary:

Job creation overseas can reduce medicine and healthcare costs, foster innovation, and enhance market access—particularly for Americans interested in medical tourism or international living options. Retirees allocating capital to these areas may enjoy both attractive returns and personal benefits from improved global health standards.

US Fixed-Asset Investment Drops

First nine months saw 0.5% investment decline—first such drop since the pandemic.

Source: Deloitte Insights

Commentary:

A slowdown in business investment can be an early warning for economic malaise. Retirees should review investment allocations: overexposure to cyclical sectors might warrant cutting back in favor of defensive assets like consumer goods or health care stocks. Also, consider the impact on real estate and infrastructure holdings.

US Food Production Faces Labor Crunch

US labor policies restricting immigration threaten food production stability.

Source: Deloitte Insights

Commentary:

Food supply instability isn’t just a headline issue—it’s a call to action for retirees to maintain emergency funds and access to local suppliers. Investors may explore agriculture or farmland real estate investment trusts (REITs) to diversify portfolios while helping stabilize national food resources.

US Treasury, State and Local Fiscal Recovery Funds Continue

$350 billion program remains vital for maintaining services and recovery investments.

Source: U.S. Treasury

Commentary:

Strong public finance contributes to robust local economies and rising property values—key factors for retirees' primary residences and communities. Municipal bonds are an excellent opportunity: they’re relatively secure, often tax-advantaged, and tie personal financial outcomes to improvements in public life.

Final Thoughts:

What do all these headlines mean for retirees and those approaching retirement? Opportunity and security lie in adaptation and anticipation. As the world faces demographic shifts, inflation pressures, global economic changes, and health system innovations, those prepared to diversify investments, monitor budget trends, and reconsider geographic and asset choices stand to thrive.

- Today's economic climate favors those who:

- Rebalance asset allocations regularly,

- Include inflation-resistant assets and high-quality global equities,

- Actively maintain flexibility in spending and lifestyle choices,

- Leverage healthcare, real estate, and municipal bond opportunities,

- Monitor both threats (like labor shortages or food price hikes) and new prospects (such as global healthcare initiatives or public finance programs).

Retirement isn’t just about weathering storms—it's about having the confidence and capability to enjoy life, create legacy, and safeguard loved ones regardless of the winds of change. Stay informed, stay diversified, and keep your financial “toolbox” ready for both challenges and possibilities.