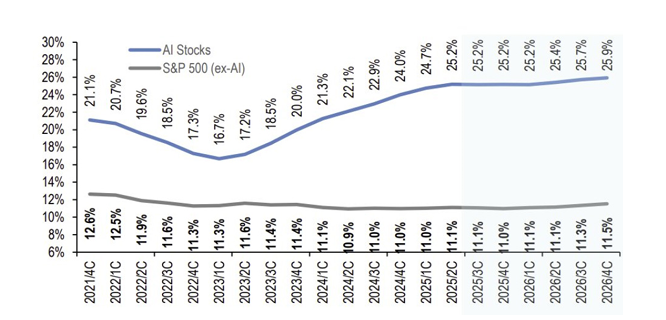

Are AI companies delivering margins yet?

Insight: Companies that identify as AI-driven show early margin and productivity benefits, but only a minority of firms have translated AI spending into durable revenue and margin gains so far. Reports from asset managers and consultants note improving margins in pockets of the S&P 500 but also caution that broad, economy-wide revenue gains are uneven. LPL Financial+1

Why it matters:

AI can boost margins where it automates costly processes or enables new high-value services — and we see that reflected in some firms’ results today. But the key point for retirees is caution: margin improvements for a handful of names do not automatically mean the whole market will deliver higher returns. For a retirement portfolio, that means (a) capture exposure to AI productivity where it’s durable, (b) avoid overconcentration in a few “AI winners,” and (c) keep expected return assumptions realistic so withdrawal plans aren’t built on transitory margin improvements.

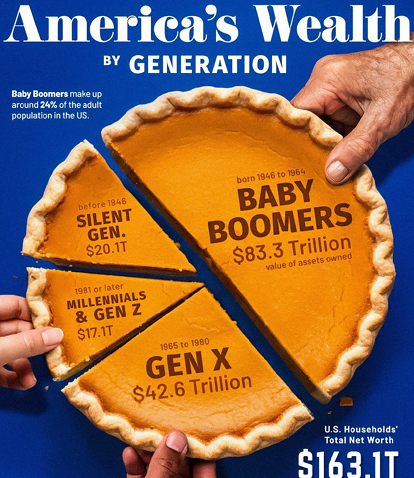

The generational wealth transfer — the “fork” question

Insight: Charts of U.S. wealth by generation show Baby Boomers still control a large share of household wealth; younger cohorts are growing their share but the wealth pie remains uneven across generations. (Example visualizations available from Visual Capitalist and St. Louis Fed research.) Visual Capitalist+1

Why it matters:

For high-net-worth households, the generational wealth picture affects estate planning, gifting strategies, and family dynamics. Practically: if you expect to pass meaningful assets, plan early for tax-efficient transfers, family education on stewardship, and clear governance to minimize friction. The “fork” metaphor is helpful: make explicit decisions about who gets which pieces and why — that planning reduces surprises and preserves relationships.

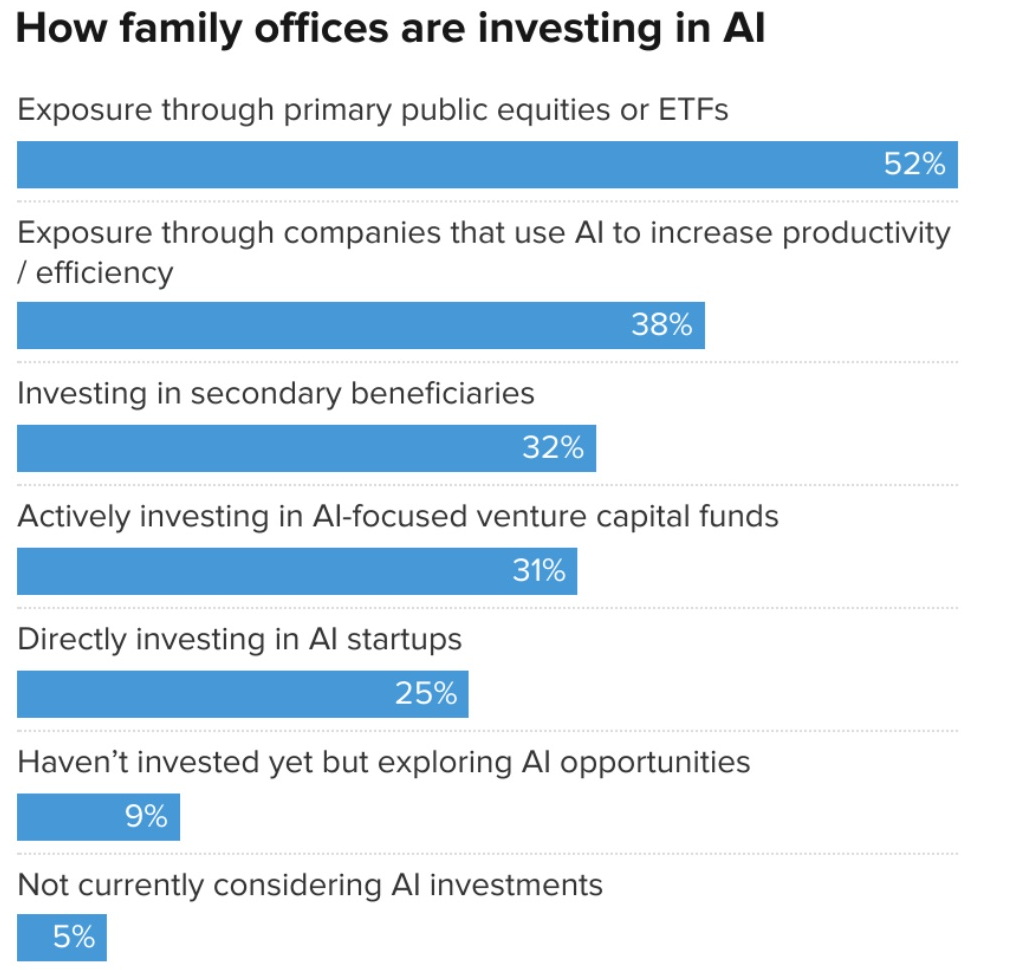

Embracing the Obvious

Insight: Family offices are signaling confidence in long-term growth while remaining disciplined in their approach … They’re prepared to stay the course, but also to lean into areas like private credit and public equities where they see compelling opportunities to generate returns. Goldman Sachs

Why it matters:

AI isn’t just speculative hype — family offices view it as both an investment theme and

a tool. That means AI is being used not only to seek returns, but to improve processes (due diligence, forecasting, risk modeling). That double role can improve return/risk tradeoffs in portfolios. Long-term perspective plus discipline is how many family offices approach it. They don’t just chase trends; they evaluate structural opportunities (e.g. public equities, private credit) and integrate AI exposure in ways that balance upside potential with prudent risk. Exposure via multiple channels instead of only backing early-stage startups, many family offices lean into established public companies using AI, infrastructure enablers, etc. For you, that means you can participate in AI’s upside without needing to take venture-level risk or lock in illiquid commitments.

CFOs: tariffs materially boost price growth expectations

Insight:

Recent CFO surveys show companies estimate tariffs account for a large share of expected unit price increases — e.g., without tariffs projected price growth would be materially lower in 2025–26. (Richmond Fed / CFO survey reporting). Federal Reserve Bank of Richmond+1

Why it matters:

Tariffs are effectively a targeted price shock to certain goods and inputs. For your retirement plan, the lesson is to stress-test spending for category-specific inflation (e.g., electronics, imported goods) rather than relying solely on headline CPI. That means building buffers or inflation-indexed components in your income plan for categories most affected by trade policy.

BNPL (Buy-Now-Pay-Later) is showing up in travel bookings

Insight:

Multiple consumer surveys show BNPL is being used for travel and vacations (reports cite significant BNPL use for travel; estimates vary by study). Empower+1

Why it matters:

BNPL can increase spending by reducing upfront friction — but it also spreads payments and can create stacked liabilities for households. For families you might support, or for younger members of your household, BNPL debt can erode savings or require you to step in. In planning terms, treat BNPL balances as debt when modeling household support or emergency liquidity needs.

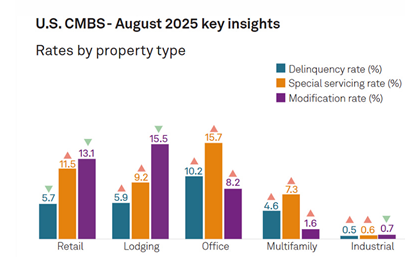

CMBS delinquency rates rising — office sector leading

Insight: CMBS (Commercial Mortgage-Backed Securities) delinquency rates have increased and are now at levels not seen since past downturns, with office loans a leading contributor. (Trepp delinquency reporting). Multi-Housing News

Why it matters:

Commercial real-estate stress (especially office) can affect broader financial markets and banks that have exposure. For a retiree, the practical point is to review any direct or indirect commercial-real-estate exposure (REITs, private funds, concentrated property holdings) and confirm liquidity and stress scenarios. If a significant part of your portfolio sits in property-related vehicles, ensure you have income and liquidity buffers to ride out asset-specific drawdowns.

Personal savings vs. market capitalization — a thin cushion

Insight:

U.S. personal saving balances are small relative to total equity market capitalization — a ratio that is historically low and comparable to other stretched periods. (FRED / Fed data). FRED

Why it matters:

When household savings are a tiny fraction of market value, it means the “cash cushion” that might fuel buying on dips or protect spending is thin. For retirees: maintain a separate, multi-year liquidity buffer (cash or short-duration instruments) so you aren’t forced to sell equities during a drawdown. Think of market cap vs. savings as a reminder to separate long-term growth assets from near-term income reserves.

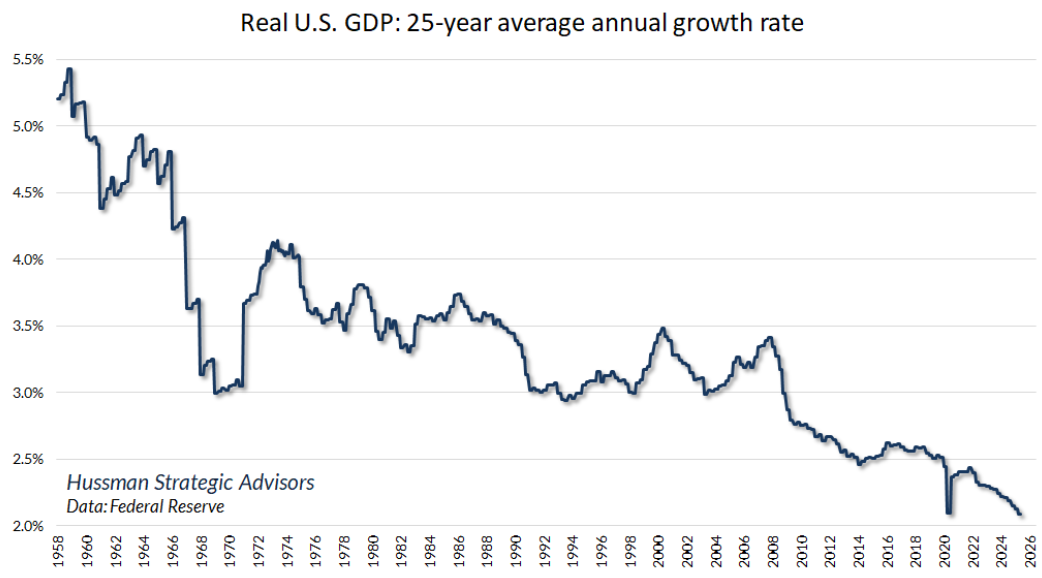

Productivity growth isn’t booming (despite big tech advances)

Insight: Long-run productivity growth in advanced economies has been modest over the past 25 years (McKinsey and other studies show productivity gains have been slower than many expect). McKinsey & Company

Why it matters:

Technology doesn’t always translate into immediate broad-based GDP growth. For portfolio construction, that means don’t assume very high future returns simply because of tech advances; valuation discipline still matters. For retirement income modeling, use conservative long-run growth assumptions and plan for scenarios where productivity gains take time to lift aggregate returns.

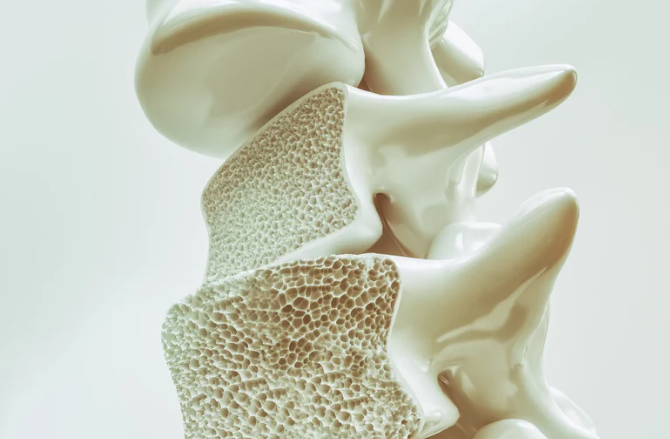

Osteoporosis & practical longevity actions

Insight:

Roughly 8 million women and 2 million men in the U.S. have osteoporosis; fractures are common and largely preventable with resistance training and strength work. (StatPearls / Healthy People / CDC). NCBI+1

Why it matters:

Longevity planning isn’t only financial — it’s health planning. Strength training and fall-risk reduction are low-cost, high-impact interventions that reduce fracture risk and downstream medical costs. Practically: when we model health-care spending, we’ll account for both baseline medical trends and the effect of preventive actions you can take — which can lower probable long-term care costs and improve quality of life.

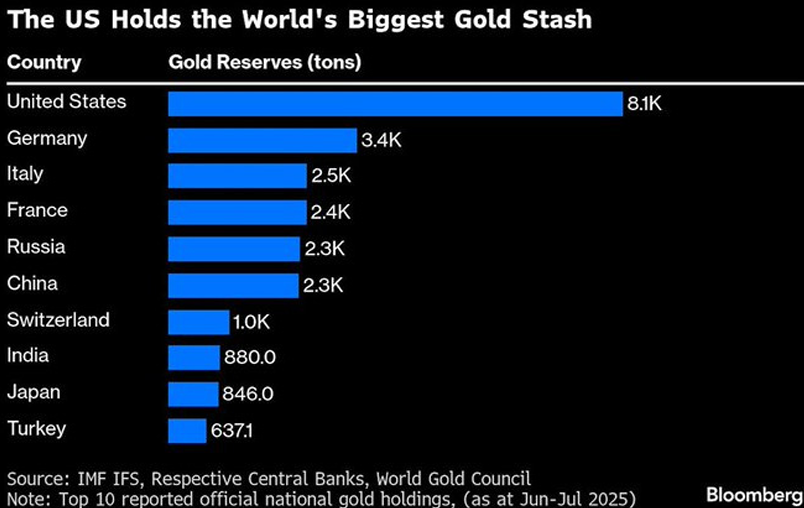

Gold: demand strong, supply growth limited

Insight: Gold demand and ETF flows surged in recent quarters; mine production grows only modestly each year (total supply ~5,000 tonnes/year; mine production up only ~1% y/y recently). World Gold Council reporting explains mine supply and recycling make up annual supply. World Gold Council+1

Why it matters:

Gold’s price is driven by demand (ETFs, central banks) more than fast supply growth — mined supply only inches higher year to year. For retirees, gold can serve as a small hedge against currency, debt, or political stress — but because it produces no income, size positions prudently (typically single-digit percentages) and hold liquid income sources for living needs.

The top 1% and extreme wealth concentration

Insight:

The top 1% of global/U.S. wealth now controls record levels of wealth (numbers vary by source; visualizations from Fed / Visual Capitalist show historic concentration). Visual Capitalist+1

Why it matters:

Concentration of wealth shapes policy debates (taxes, estate rules) and influences markets (capital flows, private markets). For estate planning and tax forecasting, assume the possibility of changing policy over a multi-decade retirement horizon and model alternative estate-tax scenarios. Also consider how concentration affects private-market deal flow and valuations if you access alternatives.

Goldman’s economic view — acceleration into 2026 (conditional)

Insight:

Goldman CEO David Solomon and other GS strategists have said the U.S. economy could accelerate into 2026, driven by fiscal stimulus and tech capex, though outcomes depend on policy and labor trends. Bloomberg+1

Why it matters:

Optimistic macro views are useful for scenario design but are conditional. For planning: translate bullish/bearish macro forecasts into concrete portfolio rules (how much to harvest, how large your buffer is, and which buckets are for growth vs income). That way you’re prepared whether growth arrives or not.

Freight volumes (Cass Index) are deeply weakened

Insight: The Cass Freight Index (shipments) has fallen and in some months hit lows not seen since pandemic disruptions; freight volumes are an early indicator of trade and manufacturing demand. Cass Information Systems+1

Why it matters:

Freight weakness often precedes slower corporate revenue and can affect earnings in cyclical sectors. For retirees, cyclical weakness can impact dividends and capital preservation in certain sectors (industrial, materials). Use freight and trade indicators as one input to decide if you should trim cyclical exposure or increase defensive income during downside scenarios.

3Q returns & what the quarter showed (recap)

Insight: Quarterly returns can be driven by a few large winners even when overall breadth is narrow — Q3 showed pockets of resilience in margins and AI-driven names, while other sectors lagged (Q3 earnings previews/recaps from market research). LPL Financial+1

Why it matters:

Quarterly performance is noisy. For longer-term retirement planning, avoid making allocation shifts based on one quarter’s winners. Instead, use quarterly data to check that your long-term assumptions (expected returns, withdrawal rates, required safety buffers) remain intact. If several quarters in a row contradict assumptions (e.g., persistent narrow breadth, rising yields), then it’s time to act; a single quarter rarely requires a strategy change.

Final Thoughts

When you step back from these items the single educational message is:

Retirement resilience comes from translating headline risk into manageable, testable plan changes.

Concretely, that means:

- Model multiple macro scenarios (bull, base, bear) and tie them to concrete actions: how much you withdraw, when you harvest gains, and what your liquidity buffer should be.

- Separate income from growth. Hold a multi-year liquid income bucket (cash, T-bills, short bonds) sized to your comfort level so you don’t sell growth assets in down markets.

- Treat insurance and hedges as complements, not substitutes. Small allocations to hedges (gold, inflation-linked assets, limited alternatives) can buy valuable tail-risk protection—but income still needs to come from reliable sources.

- Plan for non-market risks. Health, family support, cyber risk and policy changes are real cost drivers in retirement; include them explicitly in cash-flow tests.

- Avoid headline-driven churn. Use research and validated data (not single headlines) to decide whether to rebalance, harvest gains, or alter allocations.