Auto Sales Surge on EV Credit Expirations—But Affordability Remains an Issue

Summary: September’s auto sales spiked—primarily because consumers rushed to claim soon-to-expire EV tax credits. The average vehicle cost nears $50,000, a new hurdle for buyers (S&P Global).

Commentary: For retirees or near-retirees, affordability isn’t just a consumer headache—it’s a budgeting reality. High vehicle prices force trade-offs elsewhere in the spending plan. EV credit expiration can spark temporary sales, but as incentives evaporate, expect prices to stay elevated or rise further. Consider not only sticker price but the total cost of ownership: insurance, maintenance, fuel, and depreciation all play a role. Financially savvy retirees may benefit more from leasing, buying slightly used vehicles, or holding on to your current car longer to avoid the brunt of inflationary pressures. Discuss auto purchases as part of your overall spending and cash flow plan—don’t let impulse or herd behavior drive you off course.

Food Inflation Rises: Conagra Predicts Costs Will Surpass 4%, Led by Animal Proteins

Summary: Costs for core food items (meats, eggs) keep rising. Conagra expects inflation above 4% (Food Dive).

Commentary: Retirees often find that grocery bills are a “fixed” expense category, but inflation means that “fixed” is a moving target. Animal protein inflation particularly impacts older adults focused on health and nutrition, whether choosing high-quality meats, eggs, or dairy. Strategic shopping is critical: look for deals, utilize discount clubs, and consider gradual shifts toward plant-based proteins, which may not rise as quickly. Review your budget quarterly and use loyalty programs or senior discounts where possible. For long-term planners, talking to your financial adviser about building in higher-than-historic food inflation rates can help keep your retirement plan realistic.

Whealth™: Immigration’s Crucial Role in Healthcare

Summary: Nearly 40% of home healthcare workers are immigrants. Net zero immigration could reduce available caregivers and raise costs (American Immigration Council).

Commentary: The majority of retirees desire to “age in place,” which requires a reliable network of home healthcare workers. With future immigration restricted or frozen, the pool of available workers will shrink and competition will drive up costs—making home care less accessible for many. Proactive planning is essential: evaluate long-term care insurance, interview agencies for stability, and understand how broader policy changes affect your region. Families should consider alternative arrangements, including community-based solutions, co-housing, or even remote monitoring tech as part of a care strategy. Addressing this issue early, rather than reactively, is key to maintaining independence and lifestyle.

Carnival Cruises & Strong 2026 Bookings at Higher Prices

Summary: Carnival reports half of 2026 bookings already secured—and at higher prices (S&P Global Ratings).

Commentary: Travel is a top priority for many retirees seeking adventure and fulfillment. Carnival’s success in locking in bookings at higher price points signals strong demand, but also means that last-minute bargains are waning. Retirees benefit from advanced planning—locking in early, taking advantage of loyalty programs, and using points. Understand the details: cancellation policies, travel insurance, health protocols, and even geopolitical risk. While travel offers joy, don’t let rising costs derail your overall financial plan. Treat travel spending as an investment in happiness and well-being—plan it thoughtfully, and budget realistically so you can enjoy the experiences without stress.

AI Boom Fueled by Surge in Corporate Debt ($150B+ Raised, Up 70% YoY)

Summary: US tech firms raised over $150B in bonds in 2025, largely to expand AI capabilities (Bloomberg).

Commentary: Retirees with substantial investments in equities or bond funds should watch corporate debt trends very closely. Companies seeking to fund aggressive AI expansion are piling on new debt, which can amplify growth but also increase systemic risk if the “AI revolution” slows or backfires. Assess your portfolio for concentration—are you heavily invested in tech giants that are now highly leveraged? Consider diversification, reviewing both direct exposures (stocks, bonds) and indirect exposures (mutual funds, ETFs). Work with an adviser to understand how rising debt levels could impact dividend payouts, bond ratings, and total return. Conservative investors should be mindful that enthusiasm for AI can deflate quickly; risk management trumps excitement.

The Financial Vortex: Next-Gen Investors Struggle to Save for Retirement

Summary: Three-quarters of Gen X, Millennials, and Gen Z are caught in a “financial vortex”—competing priorities stymieing retirement savings (Goldman Sachs Survey).

Commentary: This is where retirees and pre-retirees can truly make a difference. The “financial vortex” describes the constant tug-of-war between paying off student loans, caring for family, housing costs, and saving for retirement—leaving many younger investors frustrated and disengaged. For legacy-minded retirees, being a positive example matters. Share your practical tips: automate savings, match employer contributions, review spending habits, and avoid “lifestyle inflation.” Consider discussing these issues openly at family gatherings, or start a legacy notebook capturing your financial best practices. Generosity isn’t just about giving money—it’s sharing wisdom that lasts.

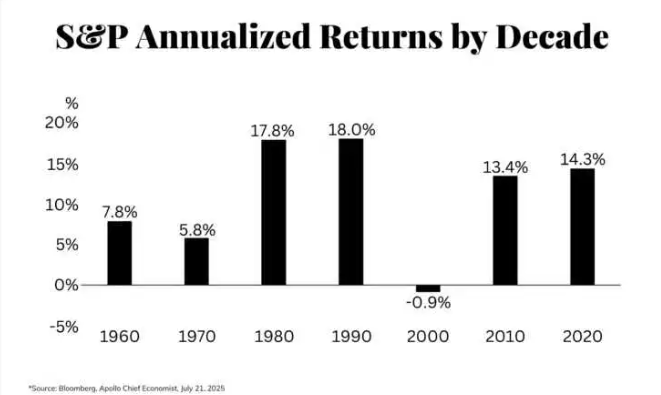

Stock Market Returns Never Hit the Average Annually—even Over 100 Years

Summary: The market’s ~10% annual average is just math; individual years are always higher or lower—not cleanly “average” (Trade That Swing).

Commentary: Many retirees mistakenly plan their spending as if portfolios will deliver a consistent “average” return each year. In reality, market returns swing wildly; one year may bring 25%, the next a loss. The key takeaway is to design withdrawal strategies that assume variability. Use a safe withdrawal rate, maintain an emergency cash buffer, and avoid reacting emotionally to swings. Understand “sequence of returns risk”—drawing down assets during poor performance can permanently shrink your portfolio. The solution: build flexibility into your spending and maintain diversified holdings. A logical, not emotional, approach supports sustainable withdrawals and peace of mind.

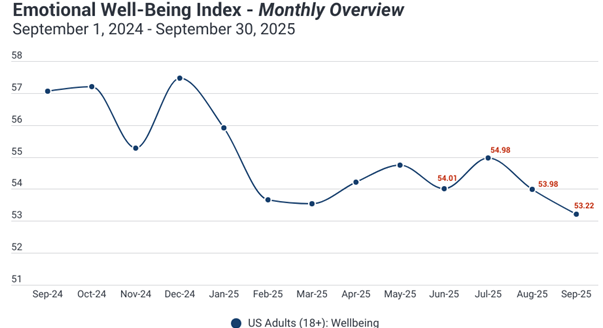

Client Sentiment: Interpreting Personal Feeling in Q4 Meetings

Summary: Financial advice is as much about empathy as analytics—Q4 meetings should probe clients’ mindset and risk tolerance (Cerulli Associates).

Commentary: Seasoned investors and advisors know that the most effective Q4 check-ins go beyond spreadsheets. It’s about understanding how market moves, inflation, or family events affect not only account balances, but clients’ sense of security and happiness. Ask open-ended questions (“What’s keeping you up at night?” “What do you truly desire from your money?”), and listen for subtle cues about fear, optimism, or even regret. Retirees are especially prone to experiencing mixed emotions—address these directly to recalibrate plans as needed. Emotional awareness isn’t “soft”—it’s essential to building trust and ensuring strategies align with life priorities.

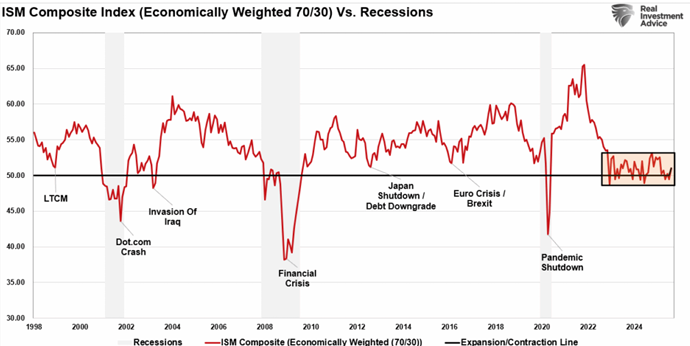

Recession Delayed? ISM Manufacturing Index Below 50 for 26 Straight Months—but Services Now Dominate

Summary: Manufacturing contraction typically signals recession—but services now “carry” 70% of US GDP (Trading Economics).

Commentary: Economic indicators from the “old days” like manufacturing data don’t tell the whole story in 2025. The pivot to services means that recessions might manifest differently, impacting sectors like travel, healthcare, tech, and leisure more than traditional factories. Retirees should review their investments across sectors—don’t rely only on manufacturing signals for asset allocation decisions. Focus on big-picture diversification, stable income (rental, dividend, pensions), and pay attention to service-sector health. Understanding this nuance helps avoid overreacting to headlines and keeps portfolios aligned with actual economic realities.

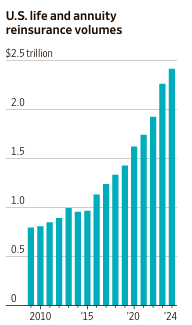

Offshore Reinsurance: Regulatory Opacity & Rising Concern

Summary: Regulators worry about opaque offshore reinsurance deals—U.S. insurers don’t always disclose who holds the ultimate risk (Insurance Business Magazine).

Commentary: Insurance is supposed to provide peace of mind—which gets harder when regulatory opacity clouds the risk landscape. If your annuities, life policies, or long-term care coverage are managed by companies that transfer risk overseas, you may unknowingly be relying on the stability of non-U.S. entities. Demand transparency: ask your agent or broker about where your policy’s risk is ultimately held, and what protections exist if that reinsurer faces a crisis. Consider working only with insurers that fully disclose their arrangements, and review rating agencies’ opinions carefully. When safety is the top goal, clarity is non-negotiable.

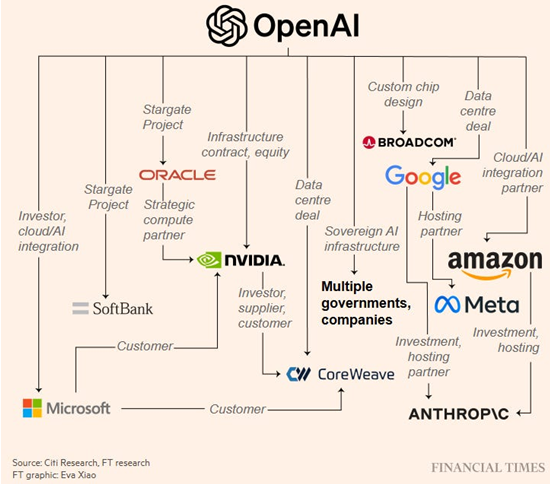

Is OpenAI the Next “Too Big to Fail?”

Summary: OpenAI’s influence, funding, and sector interdependence raise systemic risk questions (CNN Business).

Commentary: Once, “too big to fail” meant banks; now it may mean AI titans like OpenAI. For sophisticated investors, this means there’s concentration risk: if a powerful company faces a regulatory, ethical, or technical crisis, the fallout could ripple across markets quickly. It’s wise to diversify not only among companies, but also among “AI layers”—hardware providers, infrastructure, software, and adjacent industries. Assess how much your portfolio relies on any single player, and consider scenario planning for what might happen if a tech shock occurs. Alleviate systemic risk by spreading investments throughout the entire ecosystem—and by being ready to pivot if the tides change.

Investor Intelligence: Bullish Spread Hits “Extreme” as Bears Fall to 15.4%

Summary: Bulls rose from 53.7 to 57.7; bears dropped to just 15.4—a spread over 40 is considered “extreme” optimism (Charles Schwab).

Commentary: Markets are driven more by sentiment than fundamentals in the short term, and extreme bullishness is a warning sign of possible corrections. Retired investors should refrain from chasing hot trends or giving in to “FOMO.” Regularly rebalance portfolios, stick to a disciplined investment process, and avoid increasing risk just because others seem exuberant. Review asset allocations with your adviser every quarter—remind yourself that your plan is built for sustainability, not for outperforming in the short term. If the crowd is wildly optimistic—consider trimming back equity exposure and boosting cash or income-generating assets.

Final Thoughts

Retirement today is more complex than ever:

News shows forces tugging at your wallet (cars, food, travel), your future healthcare, and your investments—from AI-powered tech risk to opaque insurance and global economic shifts.

Analysis confirms the need for an adaptive, logical, and proactive approach: Balance spending priorities, scrutinize major purchases, educate younger generations, and above all, seek enjoyment and meaning from your wealth.

Expert Advice: Stay diversified, value clarity and transparency, ask hard questions, and review long-term plans quarterly with both emotional intelligence and financial rigor.

Bottom Line: For retirees and pre-retirees, successful financial stewardship isn’t about predicting the future, but about mastering the present—through sharp analysis, resilient strategies, and a relentless focus on what money can do for your life and happiness.