Apple Bug Bounty Hits $2 Million

Apple pays up to $2 million for any “bug bounty hunter” that uncovers a complex exploit that could be used to takeover its devices.

Source: WIRED: Apple Announces $2 Million Bug Bounty Reward

Commentary:

Apple’s expanded bug bounty highlights just how critical device security is. As retirees increasingly manage finances and healthcare online, their digital security becomes as important as their bank vault. Cybercrime targets affluent individuals, and few retirement plans account for the aftermath of identity theft. Review your device security, use two-factor authentication, and consider annual cyber audits with a tech professional—protecting wealth starts with protecting access.

Payments Have Doubled Since Pandemic

Monthly payments on the median home at current mortgage rates are now roughly DOUBLE what they were before the pandemic.

Source: Bloomberg: Mortgage Payments Double Post-COVID

Commentary:

Skyrocketing mortgage rates affect downsizers, investors, and those helping kids buy homes. Higher payments strain budgets and impact cash flow planning. Retirees should revisit property holding strategies, stress-test budgets for higher interest environments, and talk to heirs about realistic home buying support in today’s landscape.

Delta Sales Lift-Off — +4% YoY Growth

Delta reported a + 4% YoY sales gain stating sales trends have accelerated across all geographies and in every advanced purchase window.

Source:

Delta Q3 2025 Earnings Release

Commentary:

Travel spending is back! Retirees may face fewer travel deals and more competition for premium experiences. Early planning is essential: lock in trips, use loyalty benefits, and don’t let FOMO push you to overspend. Integrate travel as part of your retirement "joy budget," not as an impulse.

401(k) Dissatisfaction — Investors Want More Choice

In a recent WSJ poll 10% of investors are dissatisfied with their current 401(k) investment offerings and want more nontraditional options.

Source:

WSJ: Investors Want More From Their 401(k)s

Commentary:

Limited investment choices frustrate both working and retired investors. Those nearing retirement can consider IRAs, brokerage accounts, or self-directed options for flexibility. But more choice means more decisions—work with a professional to ensure diversification and avoid chasing trends at a crucial life stage.

Taxable Accounts Boom Among Middle-Income Investors

54% of Americans with incomes between $30,000 and $80,000 now have taxable investment accounts. Half of them entered the market in the past five years.

Source: JPMorgan: Individual Investor Trends

Commentary:

More Americans are investing outside retirement accounts, but newer investors may dangerously underestimate taxable consequences. Retirees should maximize tax efficiency: use tax-loss harvesting, monitor capital gains, and teach younger family members these strategies for compounding wealth.

Silver Breaks Records — First Since 1980

This week Silver prices crossed their first record px since 1980.

Source: Reuters: Silver Prices Break Long-Term Record

Commentary:

Silver’s wild run highlights commodity volatility. Retirees tempted by headlines should remember: metals are speculative, not income-producing, and often lag stocks over decades. Small allocations as a hedge are fine, but resist a major portfolio shift toward "shiny objects" that rarely deliver predictable results.

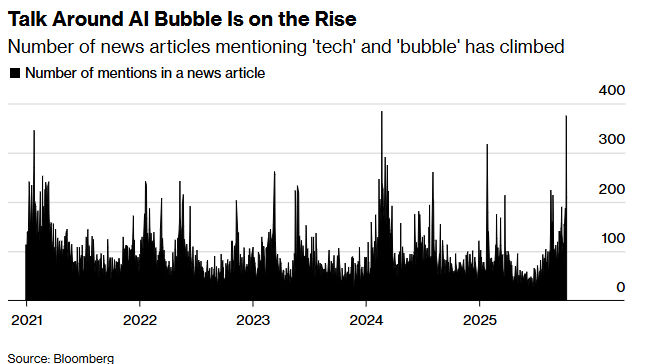

AI Stock Bubble? Majority of Managers Say Yes

A record number of global managers (54%) said AI stocks are in a bubble.

Source: Business Insider: AI Bubble Warning Bank of America Survey

Commentary:

Major managers warn of unsustainable AI stock rises. Retirees should avoid chasing overheated sectors and stick to broad, diversified tech exposure. Bubbles destroy wealth quickly for those exposed at the wrong time; prudent investors rebalance routinely and resist being swept up in the hype.

Shoppers Downsize & Coupon; Groceries Up Double Digits

From Albertsons earnings call: “shoppers are choosing smaller package sizes and using more coupons to reduce their grocery bills.”

“We see them sticking closer to their shopping list.” Over the last 12-months coffee increased 20%, ground beef 13%, bananas 6.6%.

Source: Albertsons Q3 2025 Earnings Call

Commentary:

Inflation at the supermarket impacts everyone, but especially retirees on fixed income. Smaller packages, couponing, and stricter shopping lists are real household strategies. Budget reviews—and maybe culinary creativity—are a must. Consider bulk buying, alternative brands, and community sharing to keep costs down.

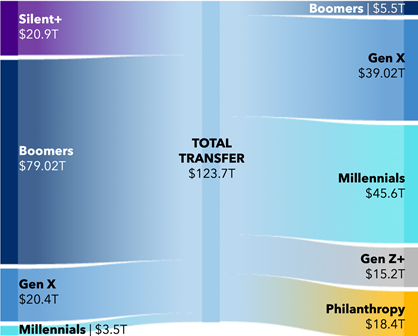

$124 Trillion Intergenerational Wealth Transfer Coming

$124 trillion will be inherited over the next quarter-century.

Where will it end up?

Source: Cerulli Associates: US Wealth Transfer

Commentary:

The largest inheritance boom ever is underway. Smart estate planning—tax efficiency, family communication, updated documents, purpose-driven distributions—will decide whether your legacy lasts or leaks away in taxes and fees. Start the conversation early; your impact is more than monetary.

Vanguard Retirement Outlook: Readiness Improves, Debt Rises

From Vanguard’s Retirement Outlook Report for 2025:

- Just 42% of Americans are on pace to meet their retirement income goals.

- Nearly half of Gen Z workers are projected to be retirement-ready compared with just 40% of baby boomers.

- Millennials carry twice the non-housing debt load that baby boomers did at the same age.

Source: Vanguard Retirement Outlook 2025 (PDF)

Commentary:

Most Americans risk falling short on retirement income, especially older generations. Gen Z and Millennials face large debts and mixed readiness. Use your expertise to mentor them, but focus your own planning on debt reduction, income stability, and flexible spending. The earlier you address gaps, the greater your comfort and freedom.

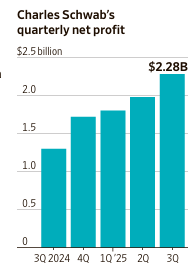

Schwab Revenue Soars on Investor Activity

As many custody with Schwab, it just reported revenues of $6.14 billion soaring by over 26% for the quarter.

Source: Schwab Q3 2025 Financial Release

Commentary:

Schwab’s record results mirror growing investor participation. For retirees, make sure custodians offer outstanding service and security—compare fees, resources, and support annually. Big institutions can help you navigate evolving financial products, but always keep your needs and costs front and center.

Final Thoughts

This collection of news stories tells the tale of retirement in a time of rapid change. Security, investment choice, inflation, sector bubbles, and legacy planning are more nuanced and urgent than ever. For affluent retirees and those nearing retirement:

- Be vigilant about digital and financial security;

- Avoid emotional investing—historical evidence beats headlines;

- Structure plans for inflation;

- Adapt your estate strategy to preserve wealth across generations;

- Seek professional input, ongoing education, and intentional decision-making.

Retirement isn’t “set and forget”—it’s an active, evolving experience. Stay curious, skeptical, and proactive, and you’ll convert uncertainty into opportunity, and wealth into lasting happiness.