Revenue Beats & Earnings Growth

About 81% of S&P 500 companies beat revenue forecasts, and the index is on track for its third straight quarter of double-digit earnings growth.

Source:

FactSet Q2 2025 Earnings Insight

Why it matters:

Strong earnings growth is the bedrock of sustainable stock returns. It tells me that many companies are exceeding expectations, not just meeting them — which is a healthy signal for equity-driven income strategies. For someone like you, who may be relying on portfolio income to fund retirement, this reinforces confidence in maintaining equity exposure, while still managing concentration and downside risks.

Home Depot: Customers Defer Major Projects Due to Economic Uncertainty

Home Depot reports that “economic uncertainty,” not just rising costs, is the main reason customers are delaying larger home improvement projects.

Source:

Home Depot Q2 earnings call; MarketWatch

Why it matters:

When major spending slows, consumer confidence likely follows. That can ripple into earnings reports and market sentiment. Your retirement plan should be flexible—so that temporary dips in spending don’t force permanent cuts to your lifestyle.

Childcare Strains Productivity

Over 1.2 million workers each month are missing work or cutting hours due to childcare issues.

Source:

Bureau of Labor Statistics

Why it matters:

This strain on the workforce hits productivity and can undermine economic growth. For your retirement plan, it underscores why diversification beyond solely U.S. domestic equities is prudent — because economic headwinds like these can impact job growth, wage pressures, and investor confidence.

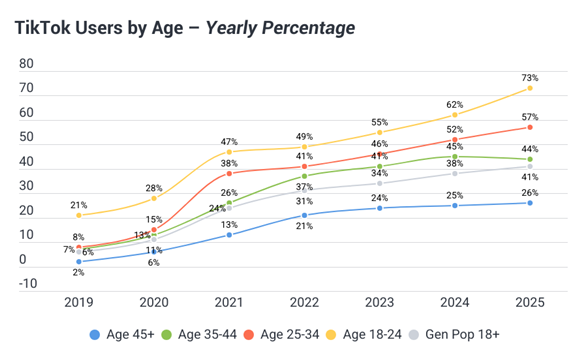

Rising Young Adult Spending Power

The age group 18–35 continues to grow in economic influence — a key demographic for marketing and investment.

Source: Demographic spending reports tiktok.com

Why it matters:

This rising cohort is shaping consumption patterns, technology adoption, and brand preferences. For your portfolio, it means opportunities to invest in companies aligned with younger generations — without abandoning what delivers for your generation. It’s about balanced exposure, not trend chasing.

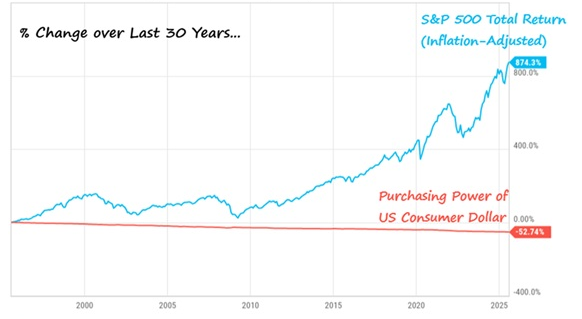

One chart showing why we must invest

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation. At the same time, the S&P 500 has gained 960% (8% per year) after adjusting for inflation

Source: r/EconomyCharts

Why it matters:

Staying invested is the key to this never-ending battle. Creating and adhering to a sound financial plan with reasonable liquidity allows more of your money to endure the ups and downs of the S&P 500. A good advisor can help you stay focused on the big picture, create a reliable distribution plan, and implement an investment strategy to keep up with inflation. Even a conservative investor should have kept up with inflation over the past 30 years but will you be able to for the next 30 years?

Crypto Expands Into Retirement Products

Laws like GENIUS, Anti-CBDC, and CLARITY acts are paving the way for crypto investments to be included in annuities and life insurance products.

Source:

Legislative developments (general news coverage)

Why it matters:

Crypto is crossing into mainstream planning, which means clients may ask about it—and expect you to understand it. While it could offer diversification upside, it may also add volatility. I help you evaluate such opportunities in the context of a well-structured, retirement-focused asset mix.

Consistent chatter about the market being over-concentrated with the Mag 7 representing ~ 35% of total SP500 market value.

Even with stocks like NVDA at 8% of the SP500 it is not the highest weighting for any stock in history.

AT&T – 13% in 1932.

GM – 8% in 1928.

IBM 7% in 1970.

The largest stocks have averaged nearly 6% of the stock market since the 1920s.

Source: Nasdaq analysis & King’s View insights

Why it matters:

Market dominance by a few companies can heighten both growth and risk. While these stocks often deliver results, a portfolio heavily exposed to them could underperform if sentiment shifts. Diversification remains essential—even in eras of market concentration.

Japanese 30-Year Bond Yields Hit 3.2% (25-Year High)

Japan’s 30-year government bond yield reached levels not seen in 25 years, climbing to around 3.2%.

Sources:

OANDA / Trading Economics

Why it matters:

Rising long-term rates overseas can ripple through global markets, affecting bond returns here at home. That means the “safe” part of the 60/40 rule might not feel so safe anymore—especially as inflation and interest rate volatility intensify.

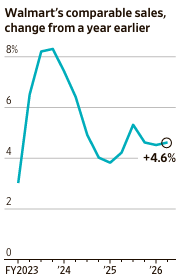

Walmart Earning Call Warns of Escalating Tariff Costs

On its latest earnings call, Walmart warned that tariff-related costs are rising steadily, even though they’re managing “for now.”

Source: Reuters news coverage, AP coverage

Why it matters:

Everyday costs—from groceries to goods—can quietly erode retirement budgets. Tariff pressures that escalate consumer prices may feel small in isolation but compound significantly over time. Your plan must anticipate these nominal but persistent drags.

Canine Cancer Detection Through Startup Innovation.

Startup SpotitEarly offers a home kit where dogs detect cancer markers via breath analysis—thanks to their incredible sense of smell.

Source:

General news on Whealth™ innovation

Why it matters:

This is more than a novelty—health breakthroughs like this could drastically reduce diagnosis costs and improve quality of life. That affects longevity expectations, healthcare cost modeling, and retirement lifestyle planning. AI and apparently a dog’s sense of smell is accelerating this!

The “Demand Gap” Narrows, Brands Reimagine Products

Source: Consumer behavior analysis

Why it matters:

Markets evolve — not always from innovation, but shifting consumer needs. When consumption shifts, sectors shift too. This creates thematic investment opportunities in areas like wellness, comfort living, and experience-based products—areas where affluent retirees often spend.

Meta Signs $10B Cloud Deal with Google

Meta just inked what could be the largest cloud contract ever—$10 billion with Google.

Source:

Business news coverage

Why it matters:

Tech titans making these bets signal long-term confidence in cloud infrastructure and AI foundations. It underscores how critical these technologies have become—and where corporate spending is going. Incorporating these macro trends into your portfolio without chasing hype, ensures exposure to innovation, just remember to be balanced with income and stability.

Final Thoughts

These insights—from earnings strength and workforce challenges to technology breakthroughs and cost pressures—remind us that real-life events shape how retirement unfolds. What keeps your lifestyle secure isn’t simply avoiding risk, but managing risk intelligently while positioning for opportunity. My promise is to distill complexity into clarity, tailoring every recommendation around your financial objectives and retirement vision.