Nintendo’s steady run (no new franchises, huge unit sales)

Insight: Nintendo’s original Switch has now sold ~153.1 million units worldwide over an eight-year run — impressive even without major new characters/franchises. 任天堂ホームページ+1

Why it matters:

A few lessons for investors and planning clients: durable consumer franchises can generate cash flow and shareholder returns for many years without dramatic product reinvention. That durability often comes from strong brand loyalty, recurring content sales (software, services), and a controlled supply/marketing ecosystem. For your portfolio, this explains why some long-lived consumer companies can be lower-volatility anchors — but it also reminds us to check whether durable profits are being reinvested wisely or simply monetized while the product ages.

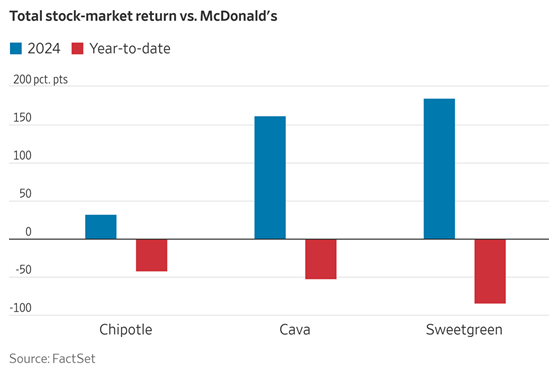

Consumer spending & restaurant traffic (McDonald’s example)

Insight: Multiple chains (including McDonald’s) reported softer comps; national restaurant foot traffic slowed in August vs July (industry data shows traffic weakness across chains). Restaurant Dive+1

Why it matters:

Restaurant sales can rise from higher menu prices while customer visits fall — that’s an important distinction. Rising ticket averages can mask weakening demand. For planning, this matters because consumer behavior affects corporate earnings and the sectors that produce dependable dividend or growth income. When spending patterns shift, rebalancing across sectors (consumer staples vs discretionary, or higher-quality service companies) can protect income streams in retirement.

U-6 underemployment jumped to 8.1%

Insight: The U-6 measure (unemployment + discouraged + involuntary part-time) rose to ~8.1% — its highest since Oct 2021. (U-6 time series: FRED/BLS data.) FRED+1

Why it matters:

U-6 captures labor market slack that headline unemployment misses. A rising U-6 suggests underemployment (people working fewer hours than they want or marginally attached) and can presage slower wage growth and consumer spending. For retirement planning, slower wage growth often means weaker contributions to retirement plans at the household level and potentially more demand for family financial support — both of which should factor into cash-flow planning and contingency reserves.

BNPL “debt stacking” & consumer strain

Insight: LendingTree finds many BNPL users hold multiple BNPL loans; ~23% of BNPL users report having three or more active BNPL loans at once (and an elevated share report late payments). LendingTree+1

Why it matters:

Buy-Now-Pay-Later products look convenient, but “debt stacking” (many small loans at once) can increase default risk and reduce household ability to save. For clients approaching retirement, that behavior can erode saving rates and increase dependence on family support or retirement assets. The practical takeaway: treat BNPL balances like other forms of debt when modeling cash flows and consider liquidity cushions or rules for family members who use BNPL heavily.

BlackRock (dollar / international opportunity)

Insight: BlackRock research advocates increased international allocation given potential dollar weakness and relative opportunities abroad. BlackRock+1

Why it matters:

Currency movements shift returns: a weaker dollar can boost dollar-denominated returns on foreign assets for U.S. investors. That’s why global diversification matters — not just sector or company diversification. Educationally, it’s useful to know how FX exposure affects total return and to consider hedging selectively (or leaning into unhedged foreign equities for a potential currency tailwind). For retirement portfolios this can improve expected returns and risk diversification over the long run.

Foreign buyers returning to U.S. housing

Insight: Foreign purchases of existing U.S. homes rose for the first time since 2017 (NAR: $56 billion of purchases Apr 2024–Mar 2025, +33% YOY). National Association of REALTORS®+1

Why it matters:

Foreign demand affects local real-estate pricing and liquidity in certain markets. If foreign buyer share rises, it can support prices in gateway cities or vacation markets — useful to know when thinking about downsizing, second homes, or regional exposure in a real-estate allocation. For retirees who own real estate, this dynamic can change the timing and tax implications of a sale.

Goldman / Morgan Stanley market outlooks (stocks may have room to run)

Insight: Investment banks (Goldman, Morgan Stanley) argue Fed cuts plus solid earnings could support further gains in U.S. stocks; Goldman projects modest upside to year-end. Goldman Sachs+1

Why it matters:

Analyst targets are useful for framing scenarios, but they’re conditional (e.g., on Fed cuts and continued earnings). Educationally, use forecasts to build scenarios — a “base case” (modest gains), a “bear case” (policy surprises), and a “stretch case.” That helps turn market views into concrete plan actions: how much to tilt toward equities, what buffers to hold, and when to harvest gains for income.

Cyber risk: blood center hack example

Insight: Hackers hit blood-center systems (New York Blood Center ransomware incident), exposing donor/patient health data — an example of attacks aimed at health / identity data, not just money. New York Blood Center Enterprises+1

Why it matters:

Cyber risk now affects personal finances directly: data theft can enable medical identity fraud, tax fraud, and theft from retirement accounts. For clients, basic protections (credit freezes, identity monitoring, careful sharing of medical records) and attention to vendor cybersecurity (health providers, financial custodians) are now part of sound planning. Think of digital hygiene as part of your “insurance” toolkit.

Twice-a-year reporting push (quarterly → semiannual)

Insight: There’s a Wall Street push (and political momentum) to allow semiannual reporting instead of quarterly — intended to lower compliance costs and encourage long-term thinking. (Coverage shows active debate.) Reuters+1

Why it matters:

Less frequent reporting could reduce short-term noise but also limit transparency. For investors, the educational point is this: if disclosure cadence changes, you’ll need to rely more on periodic fundamentals and less on quarterly headlines. For retirement investors, it means we may need to emphasize monitoring fundamentals (cash flows, margins) rather than reacting to short-term earnings surprises.

Employer health costs expected to surge (~9.5%)

Insight: Aon and other consultancies project U.S. employer health-insurance costs to rise ~9.5% in 2026 (estimates vary by firm). Aon plc Global Media Relations+1

Why it matters:

Rising employer health costs can translate into higher premiums, more cost-sharing, and larger out-of-pocket expenses — all of which affect household cash flow. For retirement planning, expect Medicare gaps and premiums to be only part of the story; employer-sponsored retiree coverage, supplemental plans, and long-term care exposures must be modeled with higher cost assumptions. Running sensitivity tests for health cost inflation strengthens plans.

Private-equity giants grew AUM materially (10-yr growth)

Insight: Firms like Apollo, Blackstone, and KKR have materially increased assets under management over the past decade (many multiples of AUM vs 2015). Quantfury+1

Why it matters:

The growth of alternative managers reflects investor demand for private markets (PE, credit, real assets). But larger AUM can change return dynamics — fee pressure, competition for deals, and liquidity management matter. For investors and retirement plans that gain access to private markets, education on liquidity, fees, and valuation frequency is essential before allocating.

401(k) flows turned risk-off in August; interest in private assets rising

Insight: In August, many 401(k) participants shifted toward conservative bonds; simultaneously, surveys show nearly half of participants said they would invest in private equity/debt if offered. Investopedia+1

Why it matters:

Behavioral point: when markets wobble, many move to safety — even if long-term plans require some growth to fund longevity. Separately, demand for private assets shows interest in yield/return enhancement. The educational tradeoff: private assets can offer higher returns but less liquidity; bonds offer liquidity but may underperform real returns over decades. Retirement design should weigh both — balancing near-term income needs with long-term growth.

Tariff-linked price pressure on consumer goods (example analysis)

Insight: A short analysis of May–Aug annualized price moves in certain goods shows sharp increases in categories sensitive to tariffs and supply shocks (coffee, bananas, electronics, jewelry, toys). Broad CPI and reporting show tariff effects accelerating consumer prices in affected categories. Investopedia+2Bureau of Labor Statistics+2

Why it matters:

Tariffs act like a targeted tax on imports: they raise costs for sellers and, ultimately, consumers. For retirement budgets, repeated small increases — groceries, household goods, electronics — compound over years and erode purchasing power. Educationally, when modeling retirement spending, it’s prudent to stress-test plans for higher goods inflation in specific categories (food, durable goods) rather than assume a single CPI rate.

Coke vs. Pepsi — operating margins comparison (fun but useful)

Insight: Coca-Cola and PepsiCo operating margins differ by product mix, pricing power, and cost structure 任天堂ホームページ+1

Why it matters:

Comparing two large brands shows how similar end markets can produce different margin profiles — because of cost structure (beverage vs snack portfolios), international exposure, and pricing power. For investors, margin stability matters for dividend sustainability and buyback capacity; for retirees it explains why some consumer staples are reliable income sources while others are more cyclical.

Final Thoughts

These headlines are useful because they each teach a practical planning lesson:

- Durability vs. novelty: long-lived consumer franchises can support predictable cash flows — but check whether profits are sustainable.

- Measure substance, not noise: rising revenues or sales can hide weakening demand (price vs traffic).

- Labor and credit metrics matter: U-6, BNPL metrics and margin debt reveal stresses that traditional unemployment or headline indexes can miss.

- Policy & macro drive pockets of inflation and opportunity: tariffs, foreign buyer flows, and Fed policy affect both costs and asset returns.

- Non-market risks are financial risks: cyberattacks and healthcare cost trends directly affect retirement security.

- Preferences & behavior: 401(k) flows and private-asset interest show investor psychology — valuable context when designing plans.

Educational next steps I recommend for clients (actionable, simple): 1) run a sensitivity test on your retirement spending for higher goods and health inflation; 2) keep a liquidity buffer to avoid forced sales when markets wobble; 3) treat alternative investments as strategic, illiquid “tilts,” not core income; and 4) add basic digital/identity protections to your risk checklist.