Individual Investors in the Options Market

Insight:

Individual investors now account for a fifth of the options market—unheard of just a few years ago.

Source:

Bloomberg

Why it matters:

The growth of retail trading in options shows how access to markets has changed. While this democratizes finance, it also introduces more volatility because many individual investors trade without institutional risk controls. For those nearing retirement, it’s important to understand that while options can hedge or amplify returns, they also carry significant risks that may not align with long-term income needs.

Average Operating Margin for Public Companies

Insight:

The average operating margin for publicly traded companies is 17.9%.

Source:

CSI Market

Why it matters:

Operating margin reflects how efficiently companies turn revenue into profit after covering operating costs. A margin near 18% shows corporate strength overall, but this number varies widely by sector. Understanding operating margin helps investors distinguish between companies with durable pricing power versus those vulnerable to cost pressures or competitive threats.

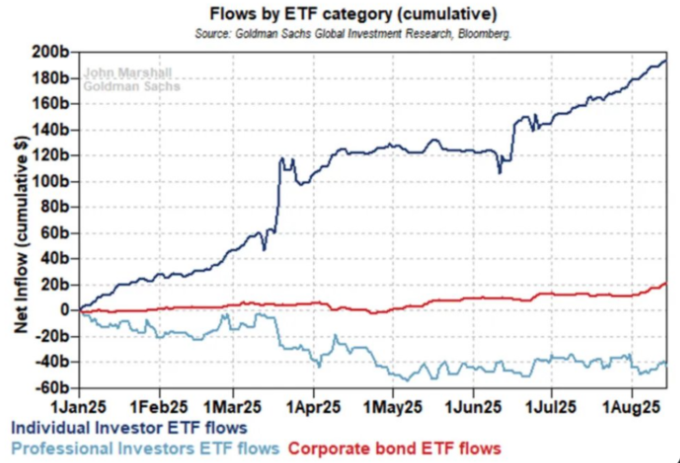

Retail Investors Driving the Market

Insight:

Retail investors remain a powerful force in market momentum.

Source:

CNBC

Why it matters:

Retail flows often add short-term swings to markets, especially in popular names. But history shows institutions ultimately set long-term direction. For retirement investors, the lesson is to avoid chasing hype cycles and instead stay grounded in fundamentals—diversification, income, and risk management.

Best & Worst Cities to Retire

Insight:

WalletHub ranked 182 U.S. cities on 45 factors. Best place to retire in 2025: Orlando, FL. Worst: San Bernardino, CA.

Source:

WalletHub Retirement Rankings 2025

Why it matters:

Location decisions affect retirement costs, healthcare quality, and lifestyle satisfaction. While rankings provide data-driven comparisons, they can’t capture individual preferences like proximity to family or climate comfort. Understanding how different variables—taxes, cost of living, healthcare—interact can help retirees make more informed location choices.

Longevity Talk Among Global Leaders

Insight:

President Xi was caught on a hot mic telling President Putin that humans may one day live to 150.

Source:

Bloomberg

Why it matters:

The conversation reflects growing global interest in longevity science. Whether lifespans reach 150 or not, the expectation of living longer has real financial implications. A longer life requires more savings, careful withdrawal strategies, and more planning for healthcare. The broader lesson is to prepare for longer retirements than previous generations faced.

Morgan Stanley: Room to Run

Insight:

Morgan Stanley projects U.S. stocks will continue to rally, citing Fed rate cuts and strong earnings.

Source:

MarketWatch

Why it matters:

Bullish forecasts highlight the connection between interest rates and stock performance. When the Federal Reserve cuts rates, borrowing becomes cheaper, often boosting profits and stock valuations. But forecasts are not certainties—understanding the factors driving optimism helps investors put market predictions in context and manage expectations.

Apartment Rents Falling

Insight:

Rents are down 0.9% YoY, vacancy at 7.1%—highest since Apartment List began tracking in 2017.

Source:

Apartment List National Rent Report 2025

Why it matters:

Rising vacancy and lower rents show how supply-demand dynamics in housing affect affordability and inflation. For real estate investors, this can pressure rental income. For tenants, it may provide relief in high-cost markets. Understanding housing trends helps investors evaluate both opportunities and risks in real estate allocations.

Data Breaches & Cybersecurity Risk

Insight:

More than 165 million individual victim data breach notifications have been issued this year.

Source:

Identity Theft Resource Center 2025 Report

Why it matters:

Cybersecurity breaches are not just technology stories—they impact personal finances, reputations, and retirement savings. With legal and financial consequences growing, cybersecurity is becoming a core part of risk management. The takeaway: financial planning now requires digital protection as well as traditional asset management.

Google Dominates Search

Insight:

Nearly three years after ChatGPT’s launch, Google still controls ~90% of global search.

Source:

StatCounter

Why it matters:

This highlights how dominant companies can adapt to new challengers and maintain market share. For investors, it’s a reminder that disruption often takes longer than expected. Evaluating technology investments means balancing enthusiasm for new ideas with an understanding of the resilience of incumbents.

Standard of Living Confidence at Record Low

Insight:

Only 25% of Americans believe they have a good chance of improving their standard of living—a record low since 1987.

Source:

Wall Street Journal

Why it matters:

Low consumer confidence can reduce spending, which in turn slows economic growth. But sentiment often lags behind economic data—people may feel worse than conditions actually suggest. Understanding this gap helps investors avoid overreacting to mood-driven market moves.

Slowest Non-Recession Spending Growth This Century

Insight:

Consumer spending growth in 2025 is the slowest of any non-recession year this century.

Source:

BEA – U.S. Bureau of Economic Analysis

Why it matters:

Consumer spending makes up about two-thirds of U.S. economic activity. A slowdown doesn’t mean a recession, but it does signal a cautious environment. Recognizing these patterns helps investors anticipate shifts in sectors most tied to discretionary spending.

Sandwich Generation & Retirement Impact

Insight:

Allianz reports 70% of the “sandwich generation” say supporting both children and aging parents has already hurt their retirement.

Source:

Allianz Life Study 2025

Why it matters:

The sandwich generation illustrates how competing responsibilities affect savings and retirement timelines. This reinforces the importance of multi-generational planning—factoring in caregiving costs, supporting dependents, and preserving retirement security. Understanding these trade-offs helps households set more realistic savings and retirement expectations.

Final Thoughts

These headlines highlight how different forces—market participation, corporate health, housing, cybersecurity, and even family dynamics—interconnect with retirement planning. The key takeaway is that successful retirement preparation isn’t about reacting to each headline, but about understanding the broader lessons they teach. By seeing how trends affect risks, opportunities, and personal finances, investors can make informed decisions that stand the test of time.