The "Gray Union" Trend: Remarriage & Cohabitation After 65

About 50% of adults over age 65 either remarry or cohabit instead of remaining single. These “gray unions” are increasingly common.

Source:

Boston University

Why it matters:

Retirement is no longer just about “me” — for many, it’s about “us,” often in blended households. Couples who marry or cohabitate later in life face unique financial questions: Which Social Security benefit is best? How do we handle unequal assets? Who pays for long-term care? Without careful planning, these situations can create financial and family tension. Knowing the rules ahead of time can help protect both partners’ financial futures.

Meta’s Massive Global Reach

Over 90% of Meta’s user base is located outside the U.S.

Source:

CIGI

Why it matters:

This highlights how global consumer behavior increasingly drives U.S. companies — and by extension, U.S. markets. Investors may think of Meta as an “American company,” but its revenue is largely influenced by international growth trends, currency fluctuations, and geopolitical risks. It’s a reminder that diversification isn’t just about owning multiple stocks, but about understanding where companies actually earn their money.

Silicon Valley Plows $100M+ Into Pro-AI Politics

Tech executives and firms are pouring over $100 million into pro-AI PACs ahead of the 2026 midterms to influence policy.

Source:

eWeek, Guardian

Why it matters:

Regulation shapes markets. Just as we saw with healthcare, energy, and banking, laws can dramatically impact growth and profitability. The lobbying around AI shows how high the stakes are. For investors, this means staying alert: regulatory outcomes could accelerate innovation or slow adoption, with ripple effects across industries.

Churches Innovate to Stay Relevant

Religious institutions are building multipurpose facilities—including coffee shops, childcare, and preschool spaces—and construction is up 17% year-over-year.

Source:

The Wall Street Journal, Baton Rouge Business Report

Memory Powered by Connection—not Just Fitness

Super-agers (those 80+) who outperform age peers in memory tests share a key trait: rich social relationships—more than diet, supplements, or exercise.

Source:

The Times

Why it matters:

Longevity isn’t just about living longer — it’s about living better. For retirees, maintaining social connections is just as critical as portfolio balances. Financial planning should factor in not just medical and housing costs, but also how clients will stay engaged and connected — because that contributes directly to quality of life.

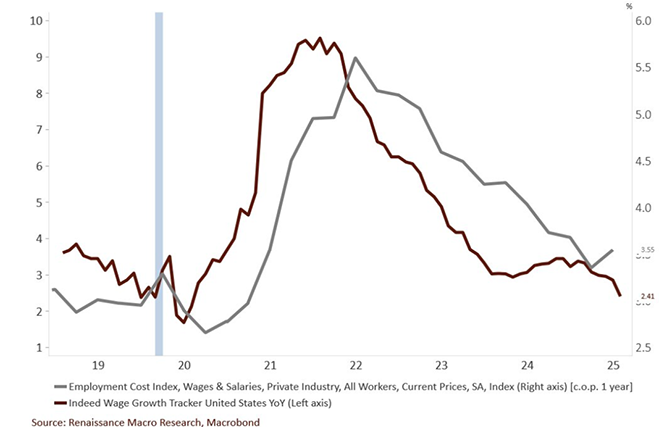

Wage Growth Slows to Near 5-Year Lows

Wage increases are now slowing, sitting near their lowest levels in five years.

Source: thehill.com

Why it matters:

Slower wage growth impacts everything from consumer spending to inflation expectations. For retirees, this can be a double-edged sword: lower inflation may protect purchasing power, but weaker economic growth could dampen investment returns. Understanding these dynamics helps set realistic expectations for portfolio growth and retirement income planning.

AI Chips Are Power Hogs

Nvidia’s latest AI chips consume energy equivalent to that of two households, and every ChatGPT query uses ten times more electricity than a Google search.

Source:

epoch.ai

Why it matters:

Every technological revolution comes with hidden costs. Just as the internet demanded massive infrastructure buildout, AI is creating new strains on global energy supply. For investors, this points to opportunities in energy efficiency, grid modernization, and sustainable tech — but also underscores risks like higher electricity costs and environmental pushback.

WISH Act Could Halve Retirement Financial Risk

Morningstar estimates the WISH Act (a proposed catastrophic insurance program for long-term services) could cut your probability of outliving assets from 42% to 19%.

Source:

Morningstar report on WISH Act investmentnews.com

Why it matters:

Long-term care is one of the biggest financial risks in retirement. Even those with significant savings can see portfolios drained by years of care. A public catastrophic insurance program would shift some of that risk away from households, potentially easing the burden on personal savings. Whether or not the WISH Act passes, it highlights the need to address long-term care costs in every retirement plan.

Long-Term Bond Yields Are Climbing Globally

French 30-year yields at 14-year highs, UK’s at 17-year highs, and U.S. 30-year yields approaching their 18-year peak.

Source:

Reuters

Why it matters:

Long-term interest rates shape everything from mortgage costs to pension obligations. Rising global yields mean higher borrowing costs, but also better income opportunities for bond investors. For retirees, this could shift the risk/reward balance between stocks and bonds in ways we haven’t seen for nearly two decades.

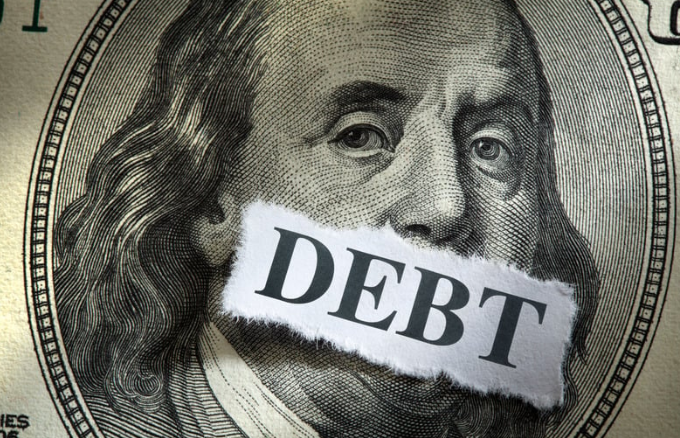

Margin Debt Hits $1T for First Time

Margin borrowing in the U.S. has hit $1 trillion—a record high.

Source:

Wall Street Journal

Why it matters:

Margin debt — borrowing against investments — can fuel stock rallies, but it also increases risk. High levels of leverage often precede market corrections, as we saw during the dot-com bust and the financial crisis. For long-term investors, it’s a caution flag: markets can move quickly when too much leverage is in the system.

Private Credit Borrowers Struggle

The share of private credit borrowers deferring interest payments rose to the highest point in nearly four years.

Source:

pionline.com

Why it matters:

Private credit has become popular because of its higher yields compared to traditional bonds. But when more borrowers struggle to make payments, the risk of defaults rises. For investors, this shows why it’s important to look beyond just the yield — considering borrower quality, diversification, and liquidity is essential. Understanding the risks behind private lending helps prevent surprises in income-oriented portfolios.

Interactive Brokers Joins S&P 500

Broker Interactive Brokers is being added to the S&P 500 index.

Source:

Yahoo Finance

Why it matters:

When a company is added to a major index like the S&P 500, it often attracts significant new investment, since index funds and ETFs must buy shares to match the benchmark. This can boost liquidity and visibility for the stock. However, investors should remember that inclusion doesn’t automatically mean a company is undervalued or a guaranteed winner — fundamentals still matter. This highlights the importance of looking past headlines and examining the real strength of a business before investing.

Trust & Estate Planning Matters

Around 58% of adults have experienced—or know someone who has experienced—family disputes due to poor trust or estate planning.

Source:

InvestmentNews.com

Why it matters:

Estate planning isn’t just about legal documents; it’s about protecting family harmony and ensuring assets are passed on as intended. Without a clear plan, misunderstandings and disputes are far more likely. Using tools like trusts, wills, and clear communication can help minimize conflict and provide peace of mind that wealth will be managed smoothly across generations.

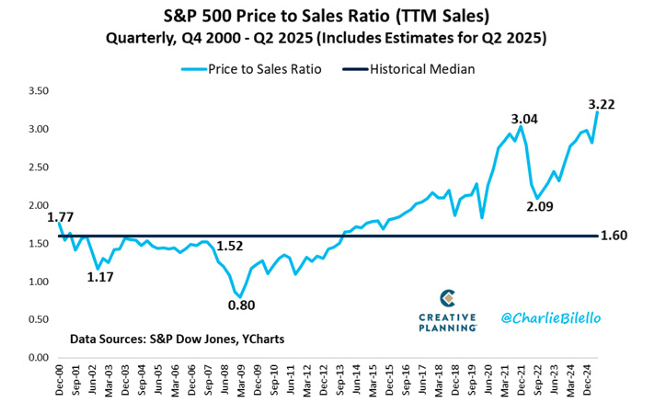

Valuation Metrics: P/E vs Price-to-Sales

While P/E remains popular, Price-to-Sales (P/S) is a significant valuation metric worth watching.

Source: Maximizations.com

Why it matters:

Investors often rely on the price-to-earnings (P/E) ratio, but earnings can be volatile, cyclical, or influenced by accounting adjustments. The price-to-sales (P/S) ratio provides another lens, focusing on a company’s revenues instead of profits. By combining multiple valuation measures, investors gain a more complete picture of whether a stock is reasonably priced — helping avoid overpaying during times of inflated earnings or hype.

Higher-Income Traffic Boosts Dollar General

Dollar General noted a meaningful increase in customers earning over $100k.

Source:

FoxBusiness

Why it matters:

Consumer behavior is shifting as inflation and higher costs push even wealthier households to shop at discount retailers. This suggests resilience in consumer spending but also signals changing patterns in where different income groups choose to spend their money. For investors, this trend highlights the importance of monitoring consumer behavior across different income levels, as it can affect the outlook for retail and related sectors.

High-Net-Worth Households Are Surging

Households with over $5 million in assets are projected to exceed $30 trillion in three years—growing at a CAGR over 9%.

Source:

QED Investors

Why it matters:

The rapid growth of wealthy households underscores the broader trend of wealth concentration in the economy. For investors, this affects everything from financial product innovation to estate planning needs and tax policy discussions. It also highlights how different tiers of wealth often require different planning approaches — from managing concentrated stock positions to navigating estate taxes and generational transfers.

Final Thoughts

Every one of these trends—whether around families, markets, innovation, or society—underscores a critical truth: retirement planning isn’t static. It demands adaptability, emotional intelligence, and strategic insight. My commitment to you isn’t just about preserving capital—it’s about constructing a life worth living, grounded in flexibility, resilience, and legacy. I strive to be more than just financial expertise for clients, when working with me, I like to think you’re securing clarity, continuity, and confidence for the retirement you deserve.