Guess what time it is?

Earnings season again. It really never ends.

At this early stage of Q4 earnings, 13% of S&P 500 companies have reported, 75% have beaten EPS estimates, and 69% have beaten revenue estimates—slightly below 5- and 10-year averages but continuing the streak of positive YOY earnings and revenue growth. The blended earnings growth rate is 8.2%, and forward P/E remains above historical average at 22.1.

Source: FactSet Earnings Insight, Jan. 23, 2026

Commentary:

For the retiree with sizable market exposure, this is a reminder: the U.S. large-cap market remains a source of resilience and, arguably, rational optimism. Yet, slightly waning rates of positive surprises suggest market expectations are lofty. If your retirement depends on portfolio withdrawals, now is the time to reassess assumptions about future returns and consider a buffer for the inevitable reversion to mean in corporate profits. Diversification, rebalancing, and keeping five years’ worth of spending needs in ‘safe’ capital, reduce the risk that market turbulence disrupts your peace of mind.

The future of ETFs? More of them and multiple share classes.

There were 30 more funds approved just last month.

Asset managers are finally bringing ETF share classes to market like their cousin mutual funds.

Sources:

Commentary:

ETFs are rapidly evolving with more share classes coming to market, akin to mutual funds. For retirees, this means two things: more ways to personalize asset location and tax efficiency, and a wider menu of cost-effective tools to execute your investment plan. Multi-class ETFs may lower costs, increase liquidity, and allow you to select tax-favored versions for taxable, Roth, and IRA buckets. But more choice is only helpful if used wisely. A disciplined framework—rather than the pursuit of novelty—should guide fund selection.

M&A Everywhere

Raymond James thought they would stay out of the M&A trade, but now they are reversing and joining the crowd with a $46b acquisition of famed Clark Capital Management.

Source:

Commentary:

For clients working with asset managers or larger advisory firms, M&A activity means your service experience could change—sometimes for the better (innovations, stability), sometimes worse (integration friction, generics replacing tailored solutions). Be vigilant during transitions. Ask your advisor about changes in investment process or client service, demand clear communication, and review your account statements for changes in fees (which sometimes creep up with larger conglomerates).

Two-thirds of all assets are controlled by just 10% of firms

$14T for BlackRock is almost no longer surprising.

But Morgan Stanley barreling straight towards $10T shows it’s open market.

Sources:

Commentary:

Wealth is concentrating among a handful of behemoth firms (BlackRock at $14T, Morgan Stanley towards $10T). Retirees should recognize the good (resources, innovation, economies of scale), and the risk (bureaucracy, groupthink, product-push). Being with a mega-firm won’t save you from the need for personalized advice. Still, sheer size brings access to markets, tools, and institutional resources individual investors can leverage. Don’t mistake logo for fiduciary. Demand transparency and accountability.

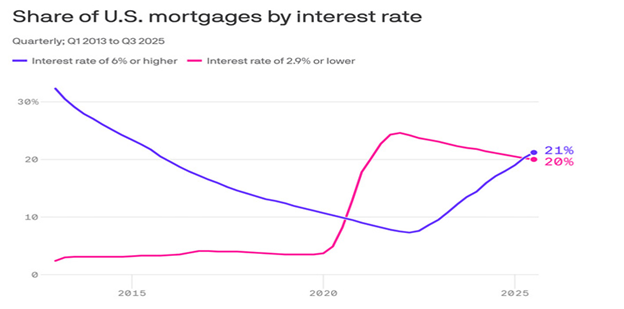

Last week saw a drop in average 30-year mortgage rates to around 6.18% spiking refi’s by 40% w/o/w.

Sources:

Commentary:

A drop to around 6% on 30-year mortgages caused a 40% week-over-week spike in refinances. In retirement, this affects you two ways: 1) Lower rates make downsizing or unlocking equity more attractive. 2) If you’re helping adult children, now may be a window for family re-fi gifts/discussion. For new retirees, lowering fixed housing costs can be a real lever in augmenting the sustainability of your income plan. Use rate troughs strategically—don’t chase them, as timing the bottom is a fool’s errand.

Elon Musk says people shouldn’t even worry about saving for retirement, predicting AI will provide healthcare and entertainment.

“It won’t matter,” he said of retirement savings.

Sources:

Commentary:

Elon Musk predicts a world of AI-powered abundance where retirement saving will be unnecessary. Entertaining as thought leadership, but, for today’s retiree: prepare for this reality, but don't bet your nest egg on it arriving soon (or ever in your lifetime). The prudent path is to plan for self-sufficiency, with an eye toward adapting your plan as technological and social realities evolve. Real-world advice rarely rhymes with billionaire futurism.

Technology has become the leading deal killer for succession plans.

Data storage and movement of files coupled with compliance demands can sink firm’s succession hopes.

Sources:

Commentary:

For business-owner retirees looking to sell or transition, data management and compliance headaches are now the #1 deal breaker in succession plans. Outdated technology can instantly wipe out decades of blood, sweat, and tears by tanking valuation or derailing handover. If your retirement depends on selling a business, invest now in updating records, cybersecurity, and making transition-ready processes. Your future self (and family) will thank you.

71% of licensed real estate agents did not sell a single home in 2025.

Source:

Commentary:

If you’re relying on rental or property sales as a retirement cash flow stream, beware: the “side-hustle” era is over for many agents, and transaction volumes are way down. This means liquidity for real estate assets may not be there when you need it, and the “hot market” effect is gone. Consider your real estate as long-term, and diversify your streams of income. Also, if planning to sell, invest in making your property stand out with upgrades and professional representation; don’t expect agents to do much heavy lifting unless you’re their top client.

Foreign ownership of US Treasuries is around 30% of the market v 50% 15 years ago.

Most analysts expect this to continue to slide downward because of diversification out of the US dollar and global competition with yields.

Sources:

Commentary:

A decade and a half ago, half the market for US government debt was foreign; now, it’s closer to 30%. For retirees, this matters: less foreign demand could mean higher rates are needed to attract capital, and that inflation and government policy will become more unpredictable in the long run. For those holding significant US government debt, it’s still safe, but don’t expect 40 years of declining yields to continue forever. Balance your income portfolio to include global bonds, TIPS, and other hedges.

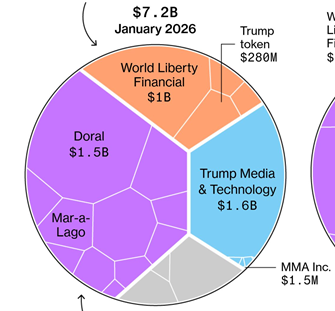

A record 20% of the Trump family wealth is tied to crypto.

Sources:

Commentary:

The Trump family's wealth is reportedly more tied to digital assets than ever—20% in crypto. For retirees, the lesson is not “go all in on Bitcoin,” but rather that digital finance is major-league. Consider very modest allocations as a speculative diversifier with extreme volatility, but don’t let the headlines (or famous names) lure you into FOMO (fear of missing out) decisions. The “crypto wealth effect” is real for a few—but for most retiree portfolios, trust in a disciplined, diversified approach with the majority of your nest egg.

Final Thoughts: Takeaway for Thriving in Retirement

If there’s a common thread in all this news, it’s the steady march of innovation—matched by both opportunity and complexity. Your job as a retiree is to be an educated skeptic: seize the opportunities (lower mortgage rates, evolving ETFs, robust markets), dodge the pitfalls (over-concentration, speculative fads), and always align your portfolio with your needs, not media hype or celebrity predictions.

Above all:

- Revisit your retirement plan annually, incorporating new tools (ETFs, tech, rates).

- Use market optimism to lock in gains and de-risk, not to chase returns.

- Maintain the agility to respond to new trends, while staying grounded in fundamentals—be it in investing, business succession, or personal asset management.

The secret isn’t knowing the future. It’s being ready for the present—and flexible enough to thrive, no matter what the world throws your way.