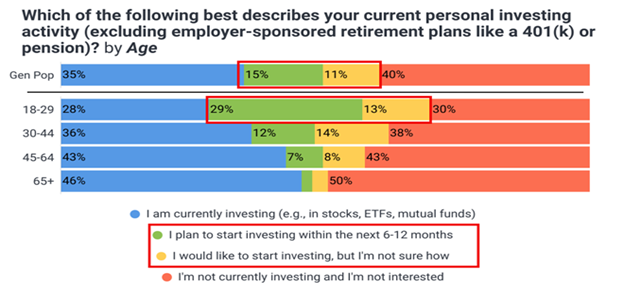

Most Retirees Lack a Formal Investing Strategy

A majority of older adults invest, but a significant proportion say they’d like to start—or improve—investing but don’t know how.

Source: McKinsey: Superagency in the workplace – 2025

Commentary:

Having a formal, written investment strategy is crucial as you approach and live through retirement. This clarity reduces emotional decisions in volatile markets and aligns your income, spending needs, and risk levels. Even basic planning, like an investment policy statement, dramatically improves outcomes and confidence.

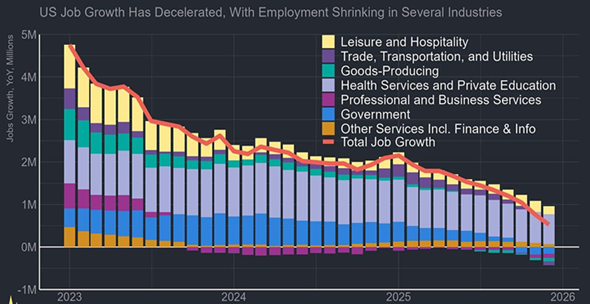

Job Growth Hits Lowest Level in Years

The US added only 525,000 jobs last year—the slowest growth since 2020. Construction job gains are essentially zero.

Source: Indeed Hiring Lab: 2025 Labor Market Update

Commentary:

Slower job growth, especially in reliably stable sectors like construction, weakens wage growth and retirement system inflows. This economic trend underscores the need for robust, self-sustaining retirement income planning rather than over-relying on Social Security or pension promises.

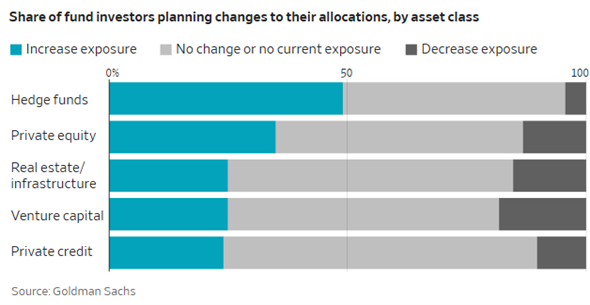

Private Credit Investors Want Out

For the first time in the private-credit boom, large numbers of individual investors are racing for the exits.

Source: WSJ: Private-Credit Investors Are Cashing Out in Droves

Commentary:

Liquidity risk is real: many who sought higher yield in exclusive alternatives now fear being unable to access their money. Retirees need to balance the hunt for return with access to funds—especially in uncertain markets. Diversification and liquidity trump chasing trends.

Most Ultra-Wealthy Clients Choose Advisors by Referral

Interviews show 40% of client acquisition by RIAs for the wealthy comes from referrals, 30% from their own networks, and 30% from professional experts.

Source: Proactive Advisor Magazine: Client Acquisition Strategies

Commentary:

For retirees, referrals mean safety. Choose fiduciary advisors highly trusted by peers and experts. Reputation and real-world reviews beat advertising every time—and increase your chances of excellent advice and long, effective planning relationships.

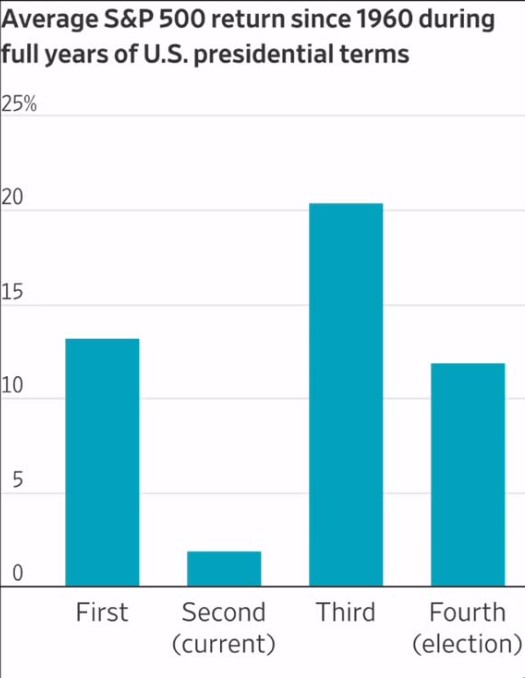

Midterm Years: Historically Weak Market Returns

Since the Kennedy administration, the S&P 500 has returned just 1.9% on average during midterm-election years.

Source: Raymond James: Midterm Election Years Stock Market Data

Commentary:

Don’t expect outsized returns in election years. Retirees should use these weak historical averages to plan more cautiously, maintain emergency reserves, and avoid betting their annual income needs on outsized market gains.

Tariffs Keep Raising Consumer Prices

A major CEO says, “Prices are going to continue to go up because they have to in all the various different categories.”

Source: CNBC: CEO Survey – Tariffs and Price Inflation

Commentary:

Inflation—especially on daily goods—hits retirees hardest. If you’re living on a mostly fixed income, plan for higher price levels far beyond just groceries. Consider inflation-protected investments or cost-of-living adjustments in your spending plan.

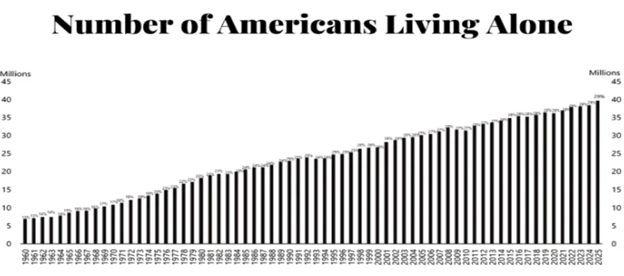

When Obvious Trends Don't Need Further Explanation

A chart or fact so self-evident even financial experts say, “If I thought this chart needed any more explanation, I would give it.”

Source: Visual Capitalist

Commentary:

Sometimes market data is so clear that denial is reckless. Retirees should learn from the obvious. Don’t rationalize away glaring realities—adapt your plans and be prepared for the unique challenges of living alone.

AI Is Already Causing Net Job Loss Overseas

Research shows the UK, Japan, Germany, and Australia are now losing more jobs to AI than they're creating.

Source: Bloomberg: AI Job Cuts Landing Hardest in Britain

Commentary:

While the U.S. hasn't seen net job loss due to AI yet, retirees and near-retirees should be alert. Economic transitions may alter everything from government benefits to the financial stability of younger family members. Keep your planning nimble.

Hedge Funds’ Best Year in a Decade

Hedge fund performance in 2025 was the best in over ten years; assets under management rose to a record $3.5T.

Source: Reuters: DE Shaw’s Funds Beat S&P 500 in 2025

Commentary:

While most retirees don’t allocate heavily to hedge funds, this sector’s strength can buoy markets and sentiment. For those considering alternatives, exercise caution—understand liquidity restrictions, fees, and how these fit with your income needs and risk tolerance.

12% of Americans Use AI Daily at Work

A 2026 Gallup poll found 12% of American workers now use AI tools on a daily basis.

Source: Gallup: AI Use at Work Rises

Commentary:

AI is mainstream, with direct implications for how you receive advice, spot scams, and get healthcare. Retirees should embrace these changes, stay vigilant for fraud, and ensure their financial and personal information is secure in an AI-powered world.

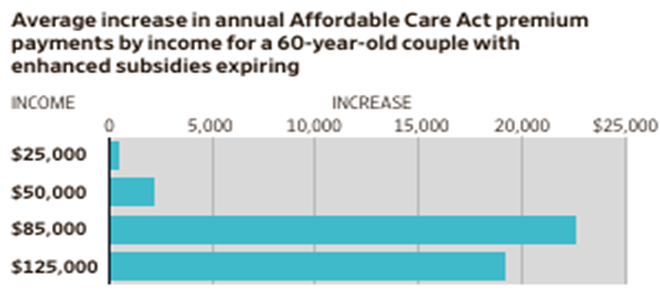

Health Insurance Costs Surge for Retirees

Health insurance premiums for retirees are spiking, causing increased stress and a greater need for careful income planning.

Source: Washington State Health Care Authority Retiree Premiums 2025 (PDF)

Commentary:

Healthcare is now the primary “wildcard” expense in retirement. Don’t underestimate rising premiums or out-of-pocket costs. Build health spending into your long-term income model and explore HSAs, Medigap, or long-term care insurance for resilience.

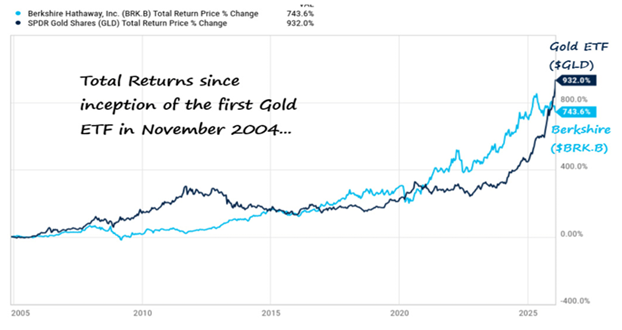

Gold’s Record-Breaking Year

Gold reached an all-time high, briefly touching $4,000/oz in late 2025 before pulling back.

Source: BullionVault: Gold Ends 2025 Up 65%

Commentary:

Gold’s record run reflects investor anxiety and volatility. For retirees, it’s a reminder that safety and diversification matter. Don’t chase past performance—use gold as a hedge, not a mainstay, and ensure your portfolio can weather downturns without overexposure.

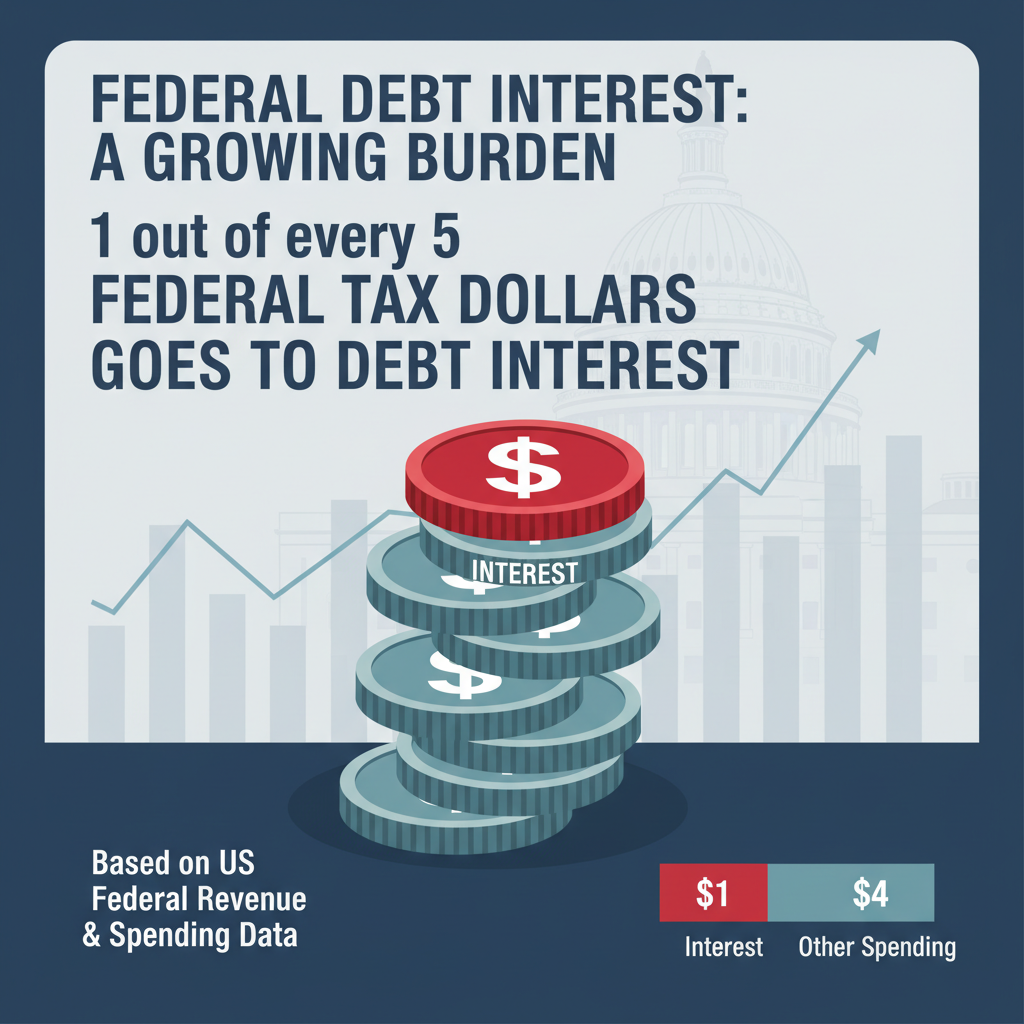

US Debt Servicing Consumes a Fifth of All Tax Revenue

$1 of every $5 in federal tax revenue now goes just to pay interest on the national debt.

Source: Peterson Foundation: US Debt Interest Costs

Commentary:

Rising debt service crowds out other federal spending. Retirees should be proactive with tax planning and maintain flexibility—future benefits could shrink, or taxes may rise. Consider Roth conversions and accelerating income from tax-deferred accounts.

GLP-1 Weight-Loss Drugs: Fast Adoption, Fast Abandonment

Nearly 18% of US adults have tried a GLP-1 for weight loss or chronic disease, but half quit within a year—often regaining lost benefits.

Source: JAMA Open: GLP-1 Discontinuation Study (2025)

Commentary:

Quick fixes often have short-lived results. In retirement, sustainable health strategies—exercise, nutrition, and holistic wellness—beat “miracle drugs.” Plan for potential medical spending, be wary of hype, and partner with reputable healthcare specialists.

Final Thoughts

Successful, enjoyable retirement in today’s world is about flexibility, purpose, and preparedness. Keep your strategy dynamic; the world won’t slow down just because you want to. Prioritize expert advice, common sense, and personal health—and revisit your plan at least annually. This approach lets you navigate even the most unpredictable news cycles with calm, confidence, and a touch of humor.