Stock Market Winning Streaks: How Rare Are Four-Year Rallies?

Commentary:

History shows stocks have posted three consecutive years of gains 11 times in the past century and four-year streaks just seven times since 1928. For retirees, this reminds us that prolonged rallies are exceptional, not the norm. Retirement portfolios should be built for resilience, not just chasing momentum. Celebrate such periods—rebalance and harvest gains—but plan for average years, too, because market cycles are part of life. Ignoring this means gambling, not investing.

Digital Detox: Real Health Benefits Confirmed

Commentary:

A single week off social media cut symptoms of anxiety, depression, and insomnia for young adults. For retirees, digital excess can similarly undermine happiness and sleep quality. Try regular "detoxes": spend time offline, reconnecting with people and hobbies. Better mental health means you’ll get more enjoyment out of your retirement—plus, you’ll be a role model for younger generations about healthy habits.

Claiming Social Security at 62 May Be Rational—Not Reckless

- Source: BenefitNews, Kitces

Commentary:

A recent study by Derek Tharp (IncomeLab) suggests that most households benefit more from claiming Social Security early, at 62, despite the advice to wait. Why? Behavioral realities: we value enjoyment now, not later. For many, the increased cash flow right after leaving work boosts quality of life and reduces stress. For those with sound savings and modest longevity expectations, this “front-loaded” spending improves retirement happiness without sacrificing security.

Retail Investors’ Growing Influence in the Stock Market

- Source: JPMorgan Chase, BMLL

Commentary:

Individuals now make up a larger chunk of trading activity than ever. For retirees, this creates both opportunity and noise: greater market accessibility can mean more “hot tips” and volatility, but also democratized investment options. Approach retail trends with caution—don’t get swept into emotional buying frenzies. Use the tools and transparency as a way to seek low fees and value, not speculation.

Talent Search Tightens—Recruiting From Shortlists

- Source: LinkedIn, Global Business Tech Awards

Commentary:

26% of companies now recruit solely from specific schools, up from 17% in 2022—a shift in hiring philosophy. For retirees, this matters if you advise younger family or volunteer for organizations: understanding the changing landscape can help guide children, grandchildren, or mentees toward smarter career planning. Also, for those seeking part-time second acts after retirement, expect more structured competition and creative screening (including photo requirements overseas, e.g. South Korea).

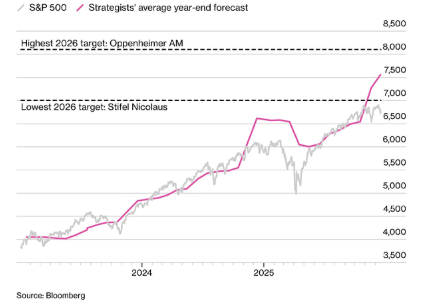

S&P 500 Needs a 30% Drop to Reach "Fair Value"?

- Source: AAII

Commentary:

Analysts point out that, based on year-end valuations, the S&P 500 could fall 30% before reaching its “fair value.” Retirees should view this as a warning—not to panic, but to review their withdrawal rates, diversification, and cash reserves. It’s about preparation, not prediction; if you’re cashing out assets soon, make sure you’re not overly exposed to high-flying equities that could correct sharply.

Minimum Wage: Most Workers Now Live in States With $15+ Minimums

Commentary:

With 19 states boosting the minimum wage, more Americans than ever earn $15/hour or more. That’s good for economic stability and consumer spending, especially for retirees whose children or grandchildren form part of the workforce. It also shapes local economies and impacts retirees running small businesses or employing help. Rising wages can fuel inflation, but also provide a safety net—valuable context for fixed-income retirees.

Venezuela’s Oil Reserve Claims: Fact or Fiction?

- Source: Reuters, Yahoo Finance

Commentary:

Venezuela, an OPEC member, claims 300 billion barrels of oil reserves—mostly self-reported, and skeptically received by analysts since Hugo Chavez’s days. For retirees invested in energy stocks or concerned about global oil prices, this matters: be aware that key data is sometimes “prestige” fiction, not fact. Diversification—not betting on headlines—is your best defense against international market surprises.

Companies Stay Private Longer Before IPOs: The Average Now? 14 Years

- Source: TheCorporateCounsel.net, Vanguard

Commentary:

Firms delay IPOs, staying private about twice as long as in the 1990s. This affects availability of direct investment opportunities and reduces retail investor access to early-stage growth. Retirees need to be choosy: consider whether opportunities are in mature, liquid markets or hidden in private equity deals with higher risks, fees, and less transparency.

Stagnant U.S. Job Growth Since April

Commentary:

Job growth has slowed considerably, with barely any new jobs added since April. For retirees, this signals possible economic headwinds that may affect the value of their investments and the financial stability of younger family members. It's also a reminder that a robust emergency fund and flexible spending are critical, especially if volatility spikes or costs rise unexpectedly.

Private Equity Management Fees Hit All-Time Lows

- Source: CNBC

Commentary:

PE firms in 2025 charged the lowest management fees on record. For retirees (particularly those with higher net worth seeking alternative investments), lower fees improve after-fee returns. But watch for the catch: discounts can signal tougher fundraising and higher risks elsewhere. Understand the structure before you plunge in—sometimes what you save on fees you pay somewhere else.

Final Thoughts

Retirement, at its best, is about confidence and flexibility. This collection of headlines reveals key lessons:

- Preparation beats prediction: Historical data, not headlines, should guide your decisions.

- Wellness matters: Financial security is crucial, but so is mental and physical health.

- Change is constant: From market dynamics to hiring philosophies, staying informed is your edge.

- Quality over quantity: Invest in sound principles and habits, not just in “trendy” opportunities or panicked moves.

- Your experience is unique: What works for others may not work for you—customize your strategy.

Most importantly, always approach retirement planning holistically. The right mix of financial, emotional, and practical preparation will help you thrive—not just survive—through whatever surprises 2026 may bring.