The True Value of Financial Advice: Peace of Mind

(A new Vanguard study of 13,400 customers suggests the true return of real financial advice isn’t performance, it’s the peace of mind that comes with having someone walking alongside your decisions.)

Source: Vanguard

Commentary:

For retirees, the emotional benefit of having an advisor—a confidant and guide—is often worth more than a few extra basis points of return. Good financial planning isn’t about chasing the hottest stock; it’s about confidence and clarity. This "peace dividend" helps you make decisions you don’t second-guess, leading to enhanced wellbeing during your retirement years.

President Trump’s Proposed 10% Cap on Credit Card Interest

(Card lenders made a record $135 billion in credit card interest and fees in 2025. The cap would alter this industry dynamic.)

Source: PBS NewsHour

Commentary:

Retirees need to pay attention to how high consumer lending fees drain retirement assets—especially for those gifting or helping family. While many millionaires don’t carry credit card debt, understanding cost structure changes can benefit loved ones and reduce financial stress in the family ecosystem.

Defense Stocks Are Up Over 20%—Profiting from Uncertainty

(Goldman Sachs basket of European defense stocks is already up 20% this month.)

Source: Morningstar Europe

Commentary:

In a world of constant uncertainty, certain sectors—like defense—offer non-correlated opportunities for retired investors. Allocating a small portion of your trusted portfolio to global security-related companies can insulate your nest egg from broader market shakiness.

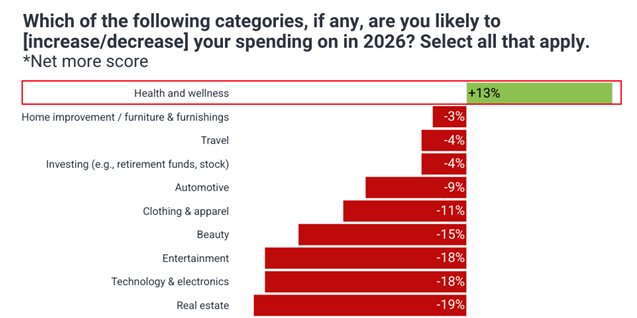

Health and Wellness Spending Set to Rise in 2026

(13% of respondents plan to increase spending in health and wellness, while most other categories see declines—1,885 responses.)

1,885 responses.

Source: NielsenIQ

Commentary:

Expect spending on personal wellness—fitness, nutrition, healthcare—to rise in retirement. This trend reinforces the need for retirees to budget and prioritize investing in their health, which ultimately yields compounding returns in quality of life.

Interest in Private Markets Among Plan Sponsors

(A new report from Cerulli Associates: 37% of retirement plan sponsors are interested in learning more about private markets.)

Source: Cerulli Associates Press Release

Commentary:

Private markets, while historically reserved for institutions, are creeping into the retiree's toolkit. They can provide diversification and reduce correlation to public markets. High-net-worth retirees should evaluate alternative assets for inflation protection and steady income.

Retired Households Face Annual Unexpected Expenses

(Center for Retirement Research: Retired households encounter at least one unexpected expense annually, averaging $7,100 or $591/month.)

Source: Center for Retirement Research

Commentary:

No plan survives reality unscathed. Building a cash reserve or guaranteed income buffer remains paramount for retirees. The real-world math—about $600 a month in surprise costs—should be factored into every retirement income strategy.

China Stocks Reach Highest Close Since 2015—Yuan and AI Bets Rise

(Chinese stocks hit a decade high, with investors piling into China AI superpower plays.)

Source: Bloomberg

Commentary:

Retirees should both seek global diversification and be cautious with concentrated bets, especially in emergent markets like China and rapidly evolving sectors like AI. Small allocations here can be a growth kicker, but don’t risk your foundation.

US Student Loan Debt Hits $1.7 Trillion—New Record

(Total US student loan debt reaches all-time high.)

Source: Federal Student Aid

Commentary:

For retirees supporting children or grandchildren, rising education costs impact gifting strategies and legacy plans. Consider using 529 plans, tax-efficient wealth transfers, or direct educational gifts as lasting tools to help family without derailing your own financial security.

Amazon Megastore—A Data-Centered Retail Revolution

(Amazon reveals a new 230,000 SF megastore in Chicago, ~30% bigger than a Walmart Supercenter. 9 in 10 Amazon customers shop at Walmart.)

Source: Wall Street Journal

Commentary:

Retail, logistics, and consumer habits are transforming rapidly. Retired investors need to spot sectoral winners, like Amazon, and be nimble with allocations to retail, e-commerce, and industrial REITs to catch the waves and avoid the wipeouts.

Wealth Creation Concentrated—Just 4% of Public Companies Generate Nearly All US Wealth

(Of thousands of US companies listed in the past century, nearly all wealth was created by just 4%. Half by fewer than 100 companies.)

Source: ScienceDirect - Journal of Financial Economics

Commentary:

Active stock-picking often fails; success comes from identifying or owning market leaders via broad indices. Retirees should ensure core portfolios are tilted toward proven, established wealth generators and avoid over-concentration in small, speculative stocks.

Mortgage Costs High Despite Median Household Income of $81,000

(Mortgages remain expensive, squeezing households even as median income sits at $81,000.)

Source: NAR Magazine

Commentary:

Real estate downsizing, leveraging equity, and using reverse mortgages for liquidity are all prudent moves. Retirees should turn high-cost real estate into low-cost, income-generating assets, or free up cash for personal spending and family support.

$38 Trillion Real Estate Wealth Transfer Set for the Next Decade

(Over the next decade, $38 trillion in real estate is expected to be passed to heirs.)

Source: Wall Street Journal

Commentary:

Proactive estate planning can minimize taxes, maximize legacy impact, and ensure the transfer is a blessing (not a curse). Retirees should update wills, trusts, and beneficiary designations, and educate heirs on stewardship—before the handoff happens.

Final Thoughts: Thriving in Retirement

The dominant themes from this week’s news spell opportunity and challenge for affluent retirees. Diversification (global, sectoral, and asset class), robust planning for risk and surprise, prioritizing health, seeking expert advice, and establishing legacy frameworks are all integral. Retirement happiness isn’t built on market returns alone—it's constructed on peace of mind, adaptability, meaningful purpose, and efficient stewardship of resources.

Retirees positioned to thrive are those who think holistically and act intentionally. Make every dollar—earned or inherited—work not just for your wealth, but for your wellbeing.